One way I keep up with the developments in cryptocurrency is I do watch some of the YouTubers since the YouTubers are generally following the juiciest developments to farm views. With the continued news that Ethereum is going to launch Eth 2.0 and is more or less on time (now called the “Ethereum consensus layer”, how catchy) how much denial there is around this fact.

Except we are way past that point now. It’s literally these YouTuber’s job to know that GPU mining is toast and today I’m going to expose how big of frauds they are, how they really built their mining farms, what they are actually doing vs. what they’re telling you and why, as well as explain what exactly is going on with Ethereum and why if you’re planning on being able to mine with those GPUs (at least above the cost of your electricity / profitably) the math is not looking good.

Why am I doing this? Because I’ve been mining since before Ethereum existed and will still be mining after Ethereum mining no longer exists so it’s pretty clear to me what is happening here.

Let’s break down what both the miners AND the Ethereum developers/community don’t seem to want to remember so we can actually understand what is happening (and when) and break it down!

Ethereum Mining Ending

Let’s start with the elephant in the room. Is Ethereum mining ending? Yes, not only is it ending, they have been trying to end it almost since Ethereum started. Within 2-3 of years it had already been decided this was going to happen.

Look at this EIP (Ethereum Improvement Proposal) from all the way back in December 2016 where it was already a foregone conclusion it was going to proof of stake: Official Ethereum EIP #186 – GitHub.

That was several difficulty bombs ago. The block reward was 5 ETH per block back then!

The Beacon Chain

Now you might say “okay, so they’ve wanted to end it forever and it hasn’t happened, so why shouldn’t we assume that it will never happen or take 5 more years”?

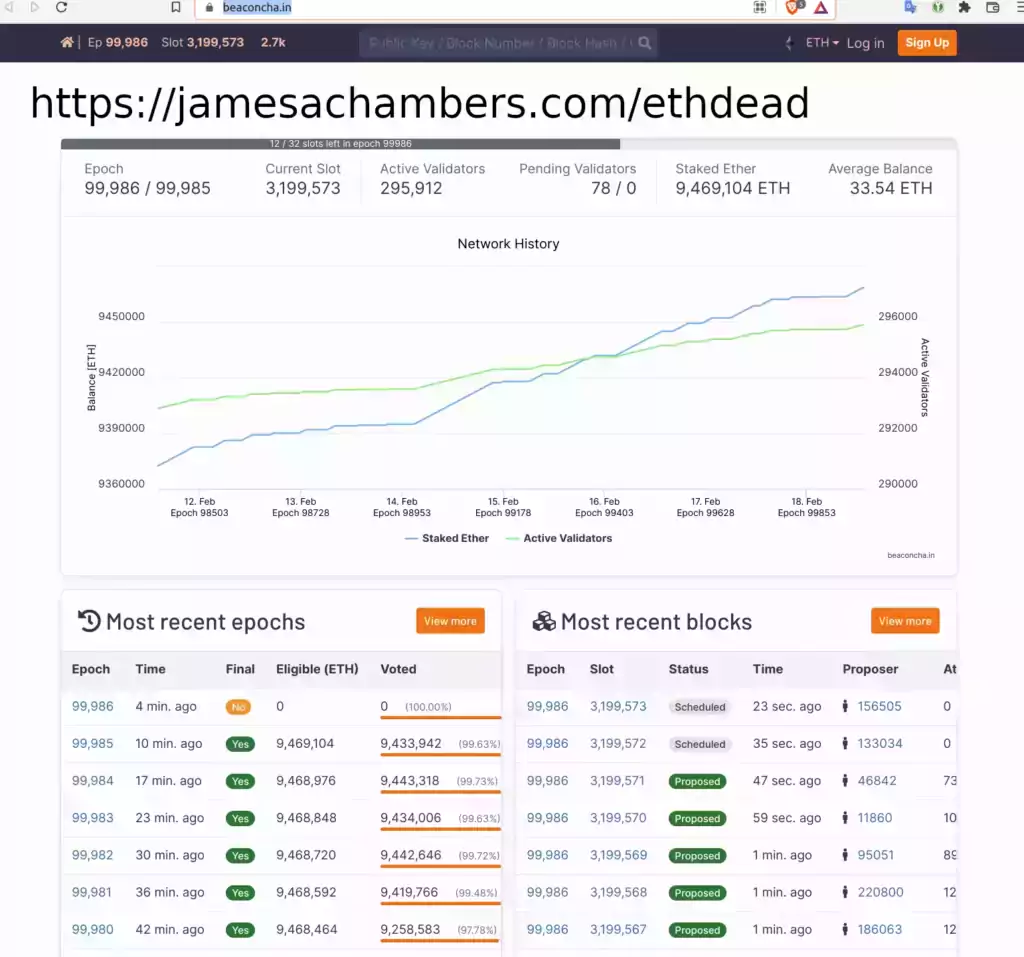

Excellent question! It’s because now Ethereum 2.0 / Ethereum consensus layer already exists. It’s not theoretical anymore. There’s no question it will work. It is working / has been working for a while.

It’s called the “Beacon Chain”. It’s a separate network from Ethereum 1.0 but it already exists today. You can already run a validator node and you can even send Ethereum to the chain and stake it for pathetic rewards vs. mining it gives with even mediocre hardware.

Seeing is believing. If you want to see the Ethereum 2.0 chain working we can use the block explorer from beaconcha.in like this:

It was launched all the way back on December 1st, 2020. This was when the Ethereum bubble was starting and after I’d bought the last GPUs I’d ever buy for mining (5x RX5700 XTs for $400/ea in early November before the price went 1k+) and started buying ASICs and have been ever since.

The Merger

So what’s left? All that is left is for them to merge Ethereum 1.0 with the Beacon chain. That is it. It’s already working. They aren’t still making it.

Right now they are planning. They want to make sure the transition goes as smooth as possible. If things went really badly it would impact the value of Ethereum and create potentially countless really serious problems / headaches for people.

They could move it today if they wanted. They really could. Think that’s a stretch? How could you possibly know that James?

The 51% Attack Threat Fiasco

Despite all of the denial back when the miners first heard about this they threatened a 51% attack. This is where miners group together to achieve greater than 50% hashpower on the coin. This allows them to start screwing with blocks as they have enough miners to make this possible.

Why? Because they are morons basically. The gas fees were hugely cut for miners and most of it is burned now. It was called EIP-1559.

It wasn’t all of us (it was a lot of the sponsored miners we’ll be talking about later though). In fact I was warning it would kill mining. And guess what? I was probably right. Look at me vs. reddit here: Reddit EtherMining Subreddit “Show of Force” Discussion

My argument was that the “Show of Force” 51% mining attack was lame and counterproductive. Want to guess how that went?

They got absolutely trounced so bad that they don’t even speak of it anymore. Vitalik Buterin presented a plan to IMMEDIATELY move Ethereum 1.0 to the Beacon chain if the miners performed a 51% attack. Were they actually ready then? Probably not, there would have been a lot of problems. They have had a year to prepare since then and they already thought they could mostly do it. That’s how you know.

If you weren’t around when this happened you may have never even heard of this. That is because it went as badly as we told them it would if not worse, and guess what? It actually does look like it’s going to mostly kill mining, and it’s *definitely* going to kill GPU mining. Even just the threat of it. It doesn’t matter that they didn’t actually perform a 51% attack.

They forced the Ethereum team into a difficult position using what they must see as weaknesses/mistakes in the past. All of the major new competitors in this last bull run were Eth-killers that already were using proof of stake and had way, way lower fees which are atrocious on Ethereum to this day. The fees are literally the worst of any cryptocurrency in the world and maybe even more expensive fees than any financial product that has ever been created on Earth. Already being proof-of-stake meant they were immune to this threat the miners were making which was making them look even more like punks against their fiercest competitors that legitimately want them dead (Eth killers). This was going to trigger their wrath.

They don’t want to talk about it because it literally advanced the timetable. They cut off their own foot. This would not be happening as soon as it is going to if this didn’t happen and create a legitimate threat that spooked Ethereum holders/investors forcing Vitalik to respond.

If we had just had a little bit more time NVIDIA was heavily making more efficient GPUs for mining that used much less power. Things didn’t have to be this way. The miners honestly forced a lot of this by being such greedy short-sighted idiots as most of them are (which is why they usually go bankrupt when the bubble is over).

This last Ethereum mining bubble was so large that most of them got away jumping in late and buying GPUs at 5x prices. In 2017 they all went bankrupt and we went in to a 3 year bear market. They’ll just get left behind on ASICs and frankly they already have if they haven’t started building their ASIC farm already.

The Current Situation

Okay, now that we’ve covered the history that neither the miners or Ethereum developers want to talk about we have enough background to explain what is actually going on here with mining. Let’s divide the miners into two groups:

- #1 – Old miners – Likely believe in decentralization and are most idealist about crypto, probably have mined other things than Ethereum before, have survived multiple bubbles, will tell you honestly if they think something is good/bad to mine as they’re experienced enough to know more people/attention to a coin actually does benefit them financially directly. Probably less than 10% of miners qualify in this climate.

- #2 – Almost everyone else – Started mining in the middle of the Ethereum bubble and buying GPUs — were successful because of the magnitude of the Ethereum bubble but would not normally have been — not likely to care about decentralization or possibly even know what it is in some cases — some of them will survive and join the “old miners” club if they can survive a bubble or two bursting and not be gone — not necessarily evil but are naive/inexperienced and super prone to greed or they wouldn’t have jumped in during the middle of a bubble at 5x prices

But wait, there’s a third category I wanted to talk to you about today.

- #3 Sponsored miners – People who received most or all of their GPUs for free during the Ethereum bubble by starting a YouTube channel to review GPUs for mining. Have never survived a bubble. Probably haven’t been mining for more than a few years at most. Did not build their farm the way they teach you. Their purpose is (was, we’ll get into it) to sell you GPUs one at a time and tell you to build their farm that way even though they didn’t and never will. This is what they’re still doing because they aren’t actually successful miners and that is all they know how to do. They’re sponsored grifters.

Sponsored Miners

I’m not sure that most people realize this. All those YouTube cryptocurrency stars? Those are not successful or even real miners. They did not buy most of those GPUs, and they definitely didn’t build their farms the way they are telling you to. That’s all sponsored gear. You definitely don’t want their advice on how to actually build a profitable farm if you, for instance, actually have to buy your gear with your own money because they didn’t. They have no idea.

What happened was when the bubble started the GPU sales went absolutely off the charts. GPU launches were the biggest thing ever. Now people largely ignore them because the availability is so poor it doesn’t mean anything unless you’re an insider. As a result of this GPU vendors started raising their prices and really wanted to cash in on this phenomena.

NVIDIA started making GPUs that were more power efficient just for mining. That’s how much these companies wanted a piece. They also started sponsoring YouTubers. Just like YouTubers that review GPUs for gaming there started to be YouTubers who covered crypto mining that started to be sent free GPUs for the exact same reason. To sell more GPUs through influencers. That is where this class of “miner” was born.

You know who I’m talking about. The people with giant towers of GPUs behind them with all the RGB lit up basically screaming “look at how badass of a miner I am”. That’s your grifters right there. Guess where they got those? Most of them came from NVIDIA, EVGA, Gigabyte, every GPU vendor you can imagine.

What happened was all of these YouTubers realized that since the companies were trying to cash in on this phenomena there was an opportunity. It wasn’t mining though, not really, and definitely not the way they are preaching to their audience pretending they are building these farms 1 GPU at a time with their hard earned money like they’re telling their audiences. They smelled a grift and they started up their channel. Take it from another content creator but one with very different audiences / motivations.

Why Sponsored Miners Recommend GPUs STILL

There’s a few reasons. The first one I touched on already which is that that has always been their job. They got a bunch of free sponsored GPUs to build a poser farm with and look like they’re some kind of badass on YouTube. That’s all they are. They didn’t build that farm actually buying them like a real miner has to. How it worked is they would get a 3070 from NVIDIA, then a 3070 from ASUS, then a 3070 from Gigabyte, and so on. Then the 3060 came out and they would do it again!

Because of that they don’t actually know anything. Some of them might legitimately not know / understand that GPU mining is ending and that these other coins couldn’t even absorb a small fraction of Ethereum’s hashrate and remain profitable. The closer we get though the lower the chances are that is the case, and they’re getting quite low which is why I’m writing this now. Too low.

The explanation is really simple. The “Eth Mining isn’t ending / GPU mining isn’t ending” denial group is very passionate about what they are saying. They need a constant drip of reinforcement to maintain this illusion. Wait until you see the numbers, and then you will understand why. They’re absolutely soul-crushing.

What do YouTubers specialize in? Making content and ultimately driving clicks about things that piss people off. It’s usually controversial topics. Topics where people will subscribe and come back so you can drip-feed them the same nonsense are the most lucrative of all. That is the “grift”. People do it in almost every topic/category and this one is even better because it also has free merchandise you get to keep from the vendors.

Could you succeed at GPU mining with dozens of free GPUs during a silicon shortage?

That’s why these guys are *NOT* successful miners. Are you kidding me? Can you imagine being handed literally dozens of NVIDIA 3000 series GPU during the biggest Ethereum bubble in history AND a silicon shortage? How could you lose? That is literally a gift of hundreds of thousands of dollars between the ETH mined and the GPUs themselves.

Do you think that person has something to teach you about mining? Why? They don’t even know as much as you do. If you had to buy your equipment you are a better and more successful miner than they are. They aren’t miners. They’re sponsored performers with literally free gear, DOZENS of GPUs. They’re circus performers generating clicks from the build in their background and the brand names on them which was an investment by the manufacturer into that YouTuber at YOUR expense (you are the target to go buy the GPU and make the manufacturer money).

In fact, it’s even worse than that. They know they are lying to you AND you are buying them their ASIC miners with the money. Why? Because ASIC miners are *much* more difficult to get for free. You’re going to get at best one of the smaller models from each manufacturer or if you’re really lucky you might get something like a KD5/KD6 on occasion is as good as it could possibly get. You’re not going to get dozens of them. They need money. A lot of money, and there’s not much time.

They’re also *way* more expensive than GPUs. Too expensive for these guys even if they haven’t managed their money very wisely. They aren’t getting crazy money from the Ethereum anymore, nobody really is that isn’t using ASICs because they’re way more efficient and powerful. They probably paid way too much for those ASICs too because of the Eth bubble but the smart ones are doing fine.

That means they need you to buy them. The one free vendor ASIC is not even going to impress an average YouTube user. Buying 5-6 more of them is going to be a problem both because of availability and price. The GPU grift is all dried up. They’ll never receive another free GPU again. That time has passed and the manufacturers weren’t sending them to the mining YouTubers because they like them.

Don’t Be Fooled

Now let’s put it all together. We’ve covered the actual state and progress of the Ethereum chain merge that will eliminate Ethereum mining. We’ve covered the motivations of the people you are most likely to get crypto information from. Now let’s put it all together.

The GPU mining content in the year 2022 is so YOU can pay for their ASICs which the vendors will never send them enough of to even pose with on YouTube. Why? Because if they don’t get some ASICs fast they are not going to have a YouTube channel in 6 months. That is no joke.

They have a limited amount of time left to milk those GPUs before most of you still watching that trash will finally wake up and realize GPU mining is toast. They probably haven’t been managing their funds wisely and thought the grift could continue but they know it now.

Mark my words, it is that very moment when those of you remaining accept that Ethereum mining is ending when… SURPRISE! All of the sudden that YouTuber who has been doing knowingly dishonest GPU mining content pretending they are building these farms 1 GPU at a time like they’re telling the viewer?

They have a ton of ASIC content now paid for with your profits from needing to consume a constant drip of soothing saying it’s okay we will mine other coins blah blah blah. No. You won’t. The numbers do not support that conclusion.

Why GPU mining can’t absorb Ethereum’s hash rate

Name a GPU mineable coin. You said Ravencoin didn’t you. Everyone always says Ravencoin when I ask that question!

It’s basically the same as it has been for the past few years. I’m going to show you, but brace yourselves.

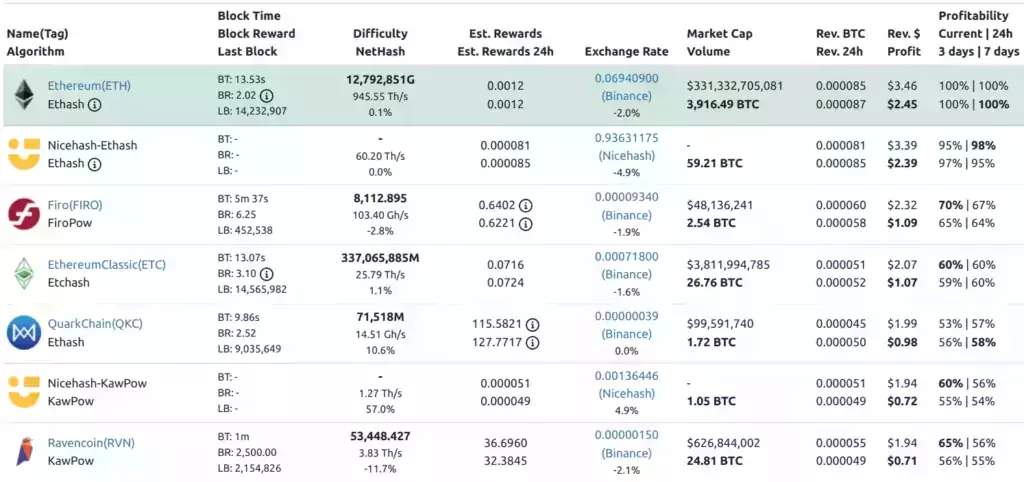

Let’s start with Ethereum Classic. GPU miners hoping to utilize this coin have a problem. It uses Ethash, the same as Ethereum, and there are ASICs for that. Those ASICs can’t mine anything else. They *HAVE* to mine Ethereum Classic or another Ethash coin of which there are some but they’re even tinier than the ones we’ll be comparing here.

What does that mean? It means since they have to mine Ethereum Classic and can’t mine the other coins the GPUs can you can scratch that one off your list. The ASICs are way more efficient than your GPUs that are also going to be homeless when Ethereum mining ends. You will not be able to compete here. It unfortunately also has by far the highest market cap of any of them of 3.8 billion.

Ethereum’s market cap is 331 billion. Let’s calculate that as a percentage to get a sense of how big Eth Classic is vs. Eth:

(3811994785 ÷ 331332705081) * 100 = 1.15%

Ok. That’s not good. Ethereum Classic, as BY FAR the biggest coin other than Ethereum that is GPU mineable, has 1.5% the market cap of Ethereum.

What happens when however many % of those people try to keep GPU mining or have to mine with their Ethash ASICs have to share a pie that is 1.15% the size of what they were getting before? They starve. You don’t make electricity. There aren’t enough daily emissions to feed you all.

Does it help if we do the calculations by hash rate? No, and they’re a lot harder to compare because a TH of hashpower on Ethash is not the same as on another coin/algorithm. You can do it though, and it scales pretty similarly to the market cap. The bigger factor will be whether there are ASICs on them because you can’t compete with the newer ASICs (9.5 GH/s in a single Bitmain ASIC, ONE!).

But what about those other coins?

We just did the biggest one and we are at 1.15% of Ethereum’s market cap. If you add them all together you won’t even break double digits. There’s nowhere to go, there’s no money in there literally. Not even if you add the entire market cap of the coins together can you find enough money for all these miners and have them make above the cost of electricity.

The fact is there are no other coins. Proof of Work is unfashionable now. Elon Musk will tweet saying you’re destroying the planet. Ethereum is feeding into this as well by touting how they’re getting rid of evil energy consuming mining to go to proof of stake. This makes all the other coins left behind on Proof of Stake look bad and no new project wants to be accused of that.

I just showed you the menu. Either 99% of both ASIC and GPU miners need to quit mining forever or you need to understand that you will be sharing from a pie that is 1-2% the size of Ethereum. Just Ethereum by itself. You also have ASICs that will be homeless that you will be competing with for Ethash (Eth Classic basically), which is by far your biggest choice.

Conclusion

If you want to keep mining then prepare. You’re going to need ASICs and / or Helium hotspots. There is no other choice as having no proof of work coins (at least that are in the spotlight) for so many years has left the landscape pretty barren. CPU mining hasn’t been profitable for years. If you think a type of mining can’t just go unprofitable and basically die then look at CPU mining, GPU mining is next.

If you want to ride out into the sunset then that is what you should do. Use what you have and keep it all as profit. Buying GPUs is only lining pockets at this point and it won’t be your pockets. Even if Ethereum mining goes on for longer than the end of the year (it won’t) the big boy ASICs from Bitmain that are 9.5GH/s will keep shipping and keep stomping on your GPUs until it’s not even worth the electricity.

Even at today’s numbers if you stopped mining Ethereum you’d be making about 60-70%. That is literally competing against nobody you already lose at least 30-40% of everything you make switching when nobody else even is. It’s going to be absolutely devastating.

I know this is a little late but this post is what stopped me from coping and I finally decided to face reality. Read this a month or two ago and decided to just start selling my gpus and started buying ASIC’s, and I didn’t even lose that much tbh. Read some of your other posts and It’s all very nicely written, keep up the good work! 🙂

Hey luci,

Thanks for stopping by, I haven’t heard anyone on this post for a while so it’s great to hear back from someone after all this time since the original publication!

I’m honestly so relieved to hear that this made a difference at least for someone. I had gone through these before in previous mining booms (such as 2017) so I kind of knew what to expect but to be honest with you it happened so fast and fell so hard that even I, someone who had gone through this multiple times before, was still shocked by the carnage. I always am. You always forget the carnage after these bubbles no matter how much you tell yourself you will never forget.

I’m still doing okay as well. I definitely wish I had chosen some different ASIC choices in some cases (my 3 LBC ASICs, ugh) but I really can’t complain and came out relatively unscathed compared to how bad it could have been for people who were doubling and tripling down when it was time to get out. I wish I had almost gone straight Starcoin (STC) ASICs as those miners use so little power but the truth is every ASIC I got to prepare for this had me better off than if I had kept adding GPUs.

I sold a lot of my GPUs that I told everyone I was going to hold until Ethereum mining ended. I actually did follow through with that and then the day Ethereum mining stopped I liquidated my 5700 XTs and my old 1080s that I had since 2015 from my original SLI gaming rig build back then (oh good old SLI). The 5700 XTs still sold for about $200 each at the time and I only paid $399 each for them originally or something like that and mined…. who knows, tens of thousands with them for sure over a couple or so years with those. Even better with the 1080s. Those 1080s had been mining since 2017 so they literally made more than their weight in gold (probably several times over).

It’s hard to say whether it would have been more profitable to dump my GPUs when I wrote this instead of mining with them until the end of Ethereum. I tried running the numbers and it actually ended up being pretty close in my case. I would have got more per GPU if I had sold when I wrote this but I went on to mine a whole bunch more Ethereum before things ended. I actually thought I would make more profit mining until the end than I did but the difficulty really started spiking toward the end with all the ASIC firepower coming online and this did hurt the earnings (and that’s not to even mention the market was drying up by that point too and starting to tank).

You’ve now joined the survivors club. You survived it! In some of my early comment exchanges with others I was telling some of the people I was debating with that statistically speaking 90% of them won’t survive this transition. You are squarely in the 10% survivor category. I wish it felt better to be in the survivor category but it’s actually kind of harrowing when you look at how many people didn’t survive it.

Thanks for sharing and take care!

Stopping in to say Hi!

Hey Vosk,

Thanks for stopping by! I allowed this through since your IP came through as a midwest dedicated server IP that is roughly where I would expect it to be. If it’s trolls then they’re much smarter trolls than usual and they got me this time, but I suspect this is you!

Sorry for putting you in the spotlight in that way. Obviously we have never spoken but you are the only person I’ve seen telling people this stuff so I wanted to shout it out. You reach very different types of audiences then I do and if even a few subscribed / saw this they can at least slowly start being eased into the truth about the situation.

Keep up the great work!

So what should I do now:

I have 38 GPUs 3080s and 3090s with 4Ghs and free power cuz of 20kW photovoltaics. Should I sell my GPUs and buy ASICS to mine BTC?

Hey Kitakaze,

Not necessarily. I also have a solar setup on my roof and it definitely helps just as much with ASICs as well!

What does your cash flow look like? Are you making enough in this market to buy ASICs or do you still owe on GPUs? If those are paid for you could just start building your ASIC farm and adding them. This is essentially what I did over a long period of time. You aren’t out of time yet.

If there’s debt involved things get trickier. If there is debt involved then it’s possible you might want to sell as many as you have to (hopefully only a handful unless there’s a *lot* of debt). Then you can keep all of the rest as they are paid for at that point. This eliminates risk and gives you some breathing room as nobody makes the 100% correct decisions all of the time in crypto because it’s so unpredictable.

My argument basically isn’t to dump your GPUs or stop mining Ethereum. It’s to start planning and understand that it is real and it is coming. You’re not completely out of time yet. There’s no way it’s happening before at least the summer time.

If you aren’t in trouble (debt) there is plenty of time to just make a course correction and slowly start picking up some BTC ASICs or whatever type of ASICs you want.

With that much hardware you could reallocate. You could diversify a little bit into some ASICs and sell off a few of them. It’s not all or nothing for sure. This is much easier if they’re paid for.

Without debt you have much better options but it’s not hopeless either way. That’s still a lot of money in hardware and that hardware still has value. Will the prices drop when this happens? Definitely (they’ve already dropped some to be honest, I see 3090s for 2500ish on eBay now and mine was 3400 in November 2020 and went even higher than that in the middle), but not to 0.

Undoubtedly some people are exiting though. Some people are doing exactly that and dumping a bunch of them on the market. It’s a trickle though compared to what it will be when it becomes crystal clear to the majority of GPU miners that this is reality. We’ve seen it before in 2017 (the majority of miners giving up on GPU mining at once) and very few people survived. It was a 3 year bear market of profits of something like less than a dollar per GPU easily.

If people haven’t been preparing though (or start doing so for the little time left remaining) I don’t know what they will do. If ASICs have a 3x-5x from a run on them I’ll be selling them a few of mine on eBay to pay for any remaining debt I have.

I couldn’t tell you exactly what to do without knowing all of the numbers in your situation but those are some of the best “routes” for some common scenarios.

For most people the right answer would be start planning for it now. This could include investing in other types of mining if they want to continue doing it / adjusting or selling inventory / diversifying into other types of crypto markets even. That will be different for everyone depending on your crypto tastes. Think of it as rebalancing your crypto portfolio to nearly 100% GPU hardware to a little bit more resilient of a blend (especially given the known risks / ultimate fate).

Anyone who does this in virtually any situation will not be in anywhere near the kind of trouble that the people who just won’t even face this will be in. The earlier you start planning for it the easier it is.

The people waiting for the “code freeze” and insanity like that are going to have the “Titanic Effect”. It’s too late to turn that ship at that point because when it goes into freeze (they can’t even fix bugs anymore when it’s frozen) you have at most weeks remaining. A situation like that is no time to have all your eggs in one basket hoping it just doesn’t happen on time.

Hopefully that helps!

Thanks for quick answer James. I really appreciare that.

I could sell all od my 3080s to buy ASICS. Actually I was thinking about BTC ASICS in last month, that’s why I found You as part of my reaserch 🙂 3090s are not payed out yet but it doesn’t matter – 16 of them. It’s not my main business, it’s more like profitable hobby. I’m definitly not in trouble – dept – just need to make decision what to do in this year. More GPUs – 3090s only – or what else… I’m glad to find Your website… You just gave me fresh look on my mining.

Hey Kitakaze,

No problem at all! I trust your judgement. As long as you just diversify a bit I think you will do just fine. You can still keep a bunch of those GPUs. It’s just to keep you safe so you’re not dead in the water as that was a very heavy GPU portfolio.

Best of luck and take care!

You mentioned the next minable coin being below 2% the size of Ethereum. What if Ethereum GPU miners own a sizable stake of Ethereum, sell out in protest, buy up the next coin in line and start mining? Seems like that massive spike in a different coin would attract a lot of attention away from Ethereum and restore some profitability back to GPU mining. I am no expert on the situation, but that seems like a very plausible option. What are your thoughts?

Hey Shoney’s BigBoy,

That’s a great question. I actually completely agree with you. That was my exact argument here against reddit (not everyone, but most of them) back in the day.

If only this had happened instead of what actually went down. It could only have been better than it is now if it did. We’re living in the worst timeline. Either we would have created the crypto we wanted to have collectively or Ethereum would have backed off a little bit and maybe done a more reasonable / less painful transition.

You are actually one of very few people besides myself I’ve ever seen suggesting anything like this. It’s really obvious to me as well. There is a *lot* of hashpower and a *lot* of money on the Ethereum blockchain that is under the control of miners. Right now they think we’re garbage. We don’t matter, and they’re right because too many miners don’t agree with us / won’t line up behind an idea like this.

This would hurt the coin badly if it actually happened. When Ethereum holders start losing money the Ethereum team’s lives become a living hell. There’s a lot of flexibility in these dates. There still is. They could delay it even further if they wanted to change directions.

Using our money is literally the only way I can think of that could possibly happen. The hour is late though. It’s getting to the point where even if they wanted to change directions they couldn’t (kind of like the Titanic). That being said, it would spook the Ethereum investors and force the devs to respond, and they will do whatever is in their best interest. It’s the same reason we got “punished” in the first place only they made it a negative interaction where they basically neutralize us instead of a negotiation. That was why attacking/threatening was dumb. Once it goes proof of stake it’s obviously too late.

It’s more than that though. All of the wealth is going to concentrate at the top extremely quickly in Ethereum. Right now the miners *are* still getting a very significant piece which spreads out the wealth. It also spreads it to people that would otherwise have none and not be in crypto at all. It’s going to be terrible for it. I already think it has a reputation as a snob crypto but it’s going to be so much worse. It’s also bad for crypto in general as Vitalik Buterin is a trendsetter as much as I don’t like that with the trends he sets. Many coins exist solely to be “Eth Killers” and would chase Vitalik wherever he goes (because that’s where the money is at right now).

Basically though I just wanted to say I couldn’t agree more. It would have to be a lot of us though and I have never been able to get anyone on board. They think I’m insane for dumping it at all (even though it’s down 40% from when I did so).

Eth devs are thieves. They dumped all their ETC post DAO. They got rich off the hack

Hey Jordan,

I’m definitely no fan of the ETH developers either. I’ve been dumping my ETH that I’d been mining since around like 2017 or so. I started doing this in early 2021 and dump every single day on the open market for BTC basically.

It’s more personal for me. I’m from the old school crypto nerd class that cares about things like decentralization, bringing everyone along, spreading the wealth and things like that. Vitalik used to believe in these things strongly in the very early days. Obviously they are now leading the charge on basically killing mining and proof of work altogether. I grew up following this man’s career and I don’t know how you get so far from where you started and your core principles. I guess the answer is simple: more money than I could possibly imagine.

I’m not opposed theoretically to proof of work evolving to be more energy efficient but everything going to proof of stake I find disturbing. I don’t think a lot of the core values of crypto carry over to the current proof of stake schemes. The proof of stake returns are absolutely pathetic unless you have a *lot* of money to stake in the first place. It’s *tiny* even today compared to what you’d make mining on even a mid range graphics card.

The result of that is that Ethereum going proof of stake is going to be just another scheme for already very rich people to get even richer and park their money. That definitely doesn’t interest me at all. That isn’t transformative or cool/interesting technology in the slightest. They should honestly be ashamed of themselves because they could have done *anything* with their market position as Ethereum. Whatever kind of mining changes they wanted. Completely new unseen stuff. Instead they’re just burning the building down on the way out.

We’re losing a lot of control over our cryptocurrencies with this transition as almost all of them have fairly exclusive/expensive schemes to become a validator and get a piece of it (some don’t allow it at all and pick/run all the validators themselves). The “power of the people” in crypto is being taken away to be given to ultra rich well-connected validators and the owners/developers of the coins is essentially what is happening here. It’s a power transfer. We get nothing from it though.

It only moves cryptocurrency away from what made it good (crypto being powered by the miners i.e. the community) to centralized staking validators which have a high barrier to entry most people can’t clear. All of the money will centralize straight to the top (even faster than it already does). If you’re just staking you’re going to need a lot of money to make anything significant and then sure it’s great. That is why it further centralizes the wealth at the top as now chances are if you’re most people you can’t afford to participate in that at a significant enough level to make anything without waiting 5-10 years.

It moves us more toward the nightmare type of government cryptocurrencies controlled by central banks. In this nightmare world instead of freeing us from the banks it ultimately gave them greater digital control over us that can basically be turned off with the flip of a switch (which normal cash can’t). I really feel like this is what we’re moving toward industry-wide and some of the more aggressive countries are already doing this and “banning” old-style cryptocurrencies like Bitcoin.

We don’t need to help this happen though with our money and I won’t. My dumping is basically just me voting “against” Ethereum with my mining power I have left on it (hasn’t been increased since November of 2020). I’m 100% with you and have been “done” with Ethereum for a while!