The Binance Smart Chain can be a dangerous place. It offers a reprieve from Ethereum’s fees with transactions costing mere pennies but despite it’s centralized nature it has struggled with new platforms getting hacked, rugpulling, scamming, and many other pitfalls.

In order to continue the journey of learning everything I can about cryptocurrency I have decided to wade through the filth and blog about my journey to outline which services ended up being legit and having value and which ones were a total sham. Today let’s talk about ApeSwap!

Introduction/Disclaimer

The purpose of this article is to document my experiences I have had using ApeSwap. I won’t be giving any investment advice and can’t/am not qualified to tell you what you should do with your crypto or your money. All I can do is tell you what my experience was and if I thought it was worth it for me or not. You should legitimately, outside of the disclaimers/legal mumbo jumbo, be extraordinarily careful with anything to do with cryptocurrency. Do your research, and consult with experts/professionals if in doubt.

The reason I dived into ApeSwap is that I had been experimenting with PancakeSwap to learn about DeFi and yield farming and had 20-30 CAKE in there when CAKE went from $15-18 to $40. I had meant to buy more CAKE but it had got so expensive that when I heard from some reputable sources about ApeSwap I decided to try doing some DeFi on there!

I have no idea if it’s going to be worth it or not yet but the numbers look promising on paper initially (I’ll share them later).

What is ApeSwap?

ApeSwap is an exchange on the Binance Smart Chain. It lets you, like most things with the Binance Smart Chain, do swaps extremely quickly and cheaply. It also offers the standard set of liquidity pooling/staking that most DeFi services offer letting you stake liquidity pairs like BNB/BUSD for 300-400% APY returns as well as non-pair traditional (and safer) staking for a lower % APY.

Basically, ApeSwap lets you exchange tokens on the Binance Smart Chain for cheap as well as yield farm. The native token of the platform is the BANANA, which probably won’t surprise you. If you have used PancakeSwap before it’s almost an exact clone (at least of the interface) but there are some differences we’ll cover later.

It’s the #12th highest volume Decentralized Exchange (DEX) and will almost certainly be larger by the time you read this article. The BANANA token has gone from about 90 cents to $8.50 at time of writing and has been as high as $11.

Determining Legitimacy

There are a ton of PancakeSwap clones out there that look just like ApeSwap. I experimented with one called JaguarSwap the other day that was offering something ridiculous like 4000% APR and most sections of the site were unfinished/not working. These types of clones are common and notorious for “rugpulling” where a bunch of people are lured in and then the whales take all their liquidity out and leave everyone holding the bag on tokens that drop 90%+ in value when all the liquidity vanishes.

In the words of Vitalik Buterin, “the most important scarce resource is legitimacy”. There’s lots of imitators, and frankly there are really only a handful of serious exchanges/liquidity farms out there worth using. More exchanges are coming all the time, some of them even great, but many of them are scams/rugpulls/etc.

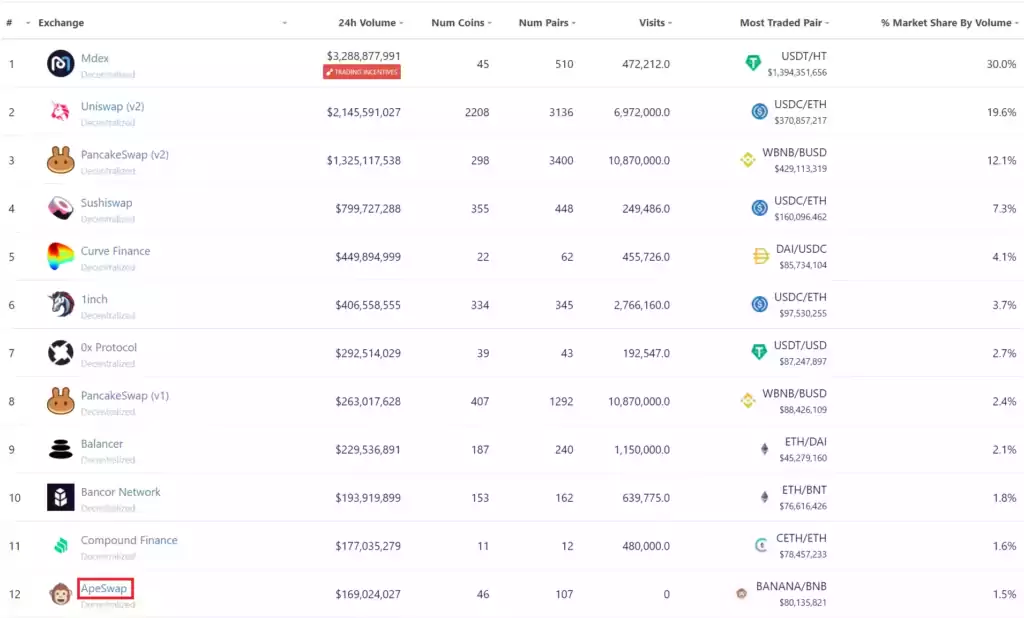

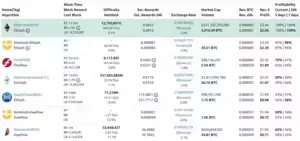

So how can we try to determine legitimacy? The first way is to look at the numbers. How big is the exchange? How much volume is there? Let’s take a look at the CoinGecko DEX chart:

ApeSwap is way up there on the DEX rankings already! It’s already #12 just barely behind Compound in 24 hour volume. We can also see the BANANA/BNB pair on the right has a respectable $80 million dollar 24 hour volume and 1.5% of the entire DEX market share.

This is already a huge exchange to be trading blows with Compound, a well established DeFi platform that has been around for some time. These numbers are impressive and help to establish legitimacy. The bigger and more established the volumes and rankings are the less likely it is you are going to be dealing with a rugpull or exit scamming. Once exchanges get this big it becomes way more profitable to continue to operate legitimately than try to pull shenanigans since the fee gravy train means the house always wins.

Another thing to note is the number of liquidity pairs. A lot of other PancakeSwap knockoffs have the main “core” liquidity pairs and basically nothing else. ApeSwap has 107 liquidity pairs including for a lot of other yield farming sites like CAKE, NUTS, etc. If you see a liquidity farming site with their token and BNB/BUSD and not much else that is a big red flag. While not nearly as many as PancakeSwap has 107 is a lot of pairs especially compared to other BSC exchanges.

One additional way to determine legitimacy on these PancakeSwap clones is the ICO (initial coin offering) section where people can launch new coins. Are other people actually launching their coin on the platform? ApeSwap has actually launched a few new cryptos on their platform so the answer is yes in this case. They call it an “Initial Ape Offering” on the platform and there have already been a few. That’s a very good sign of stability. If you see PancakeSwap lookalikes that have a ICO section with nothing in it, under construction, etc. that is another red flag.

Yield Farming

Yield farming on ApeSwap, like most DeFi, offers the highest rates. You combine two tokens together, such as BNB and BANANA, to create a liquidity pair.

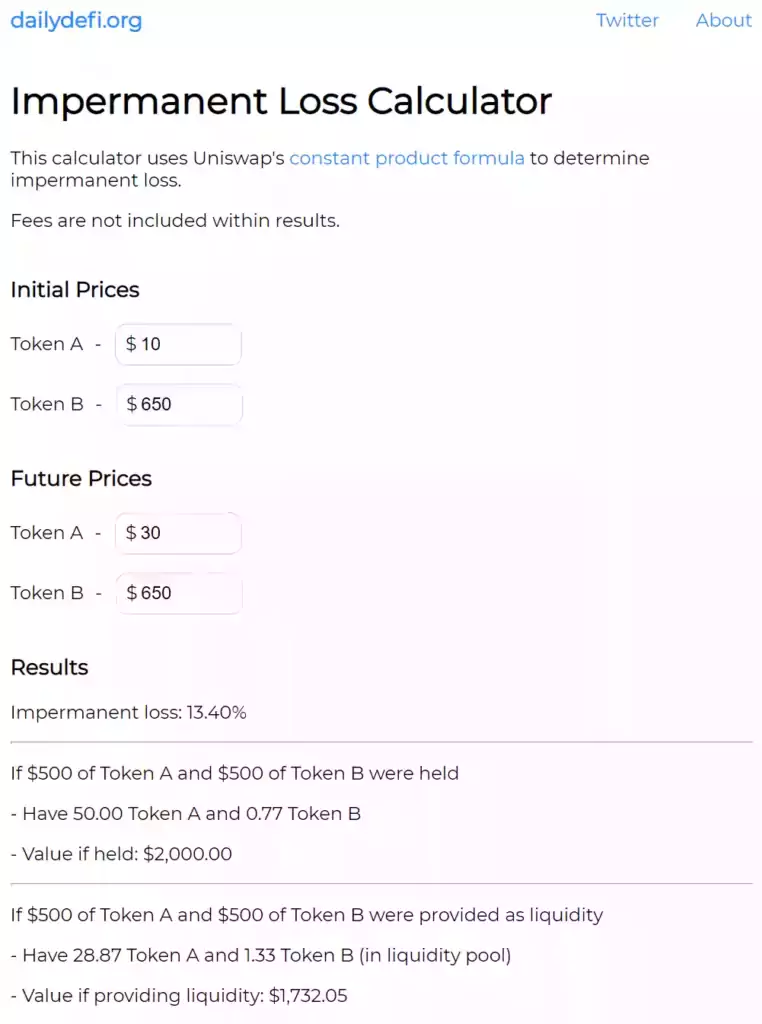

The rates are highest here because you take on the risk of “impermanent loss” with liquidity pairs which means that if the tokens change in value while you have them paired you might not get the same amount of each back unless they’re worth exactly the same as when you “paired” them. This is a difficult concept to wrap your head around but the losses can be as high as 25%.

For an example let’s say you pair BANANA and BNB together in the BANANA/BNB pair when BANANA is $10 each and BNB are $650 each. What if BANANAS rise to $30 each and BNB stays the same? We can plug this into the dailydefi.org Impermanent Loss calculator:

The rates on every DeFi platform I’ve seen way more than make up for the risk of impermanent loss (intentionally) but it’s extremely important to understand how it works before doing this type of yield farming. Use the calculator and do some calculations to understand how this works before farming.

I am currently utilizing the farming and have found it to work well and have not had any problems. If you are trying to earn more bananas this was the fastest way I found on the platform.

Staking Pools

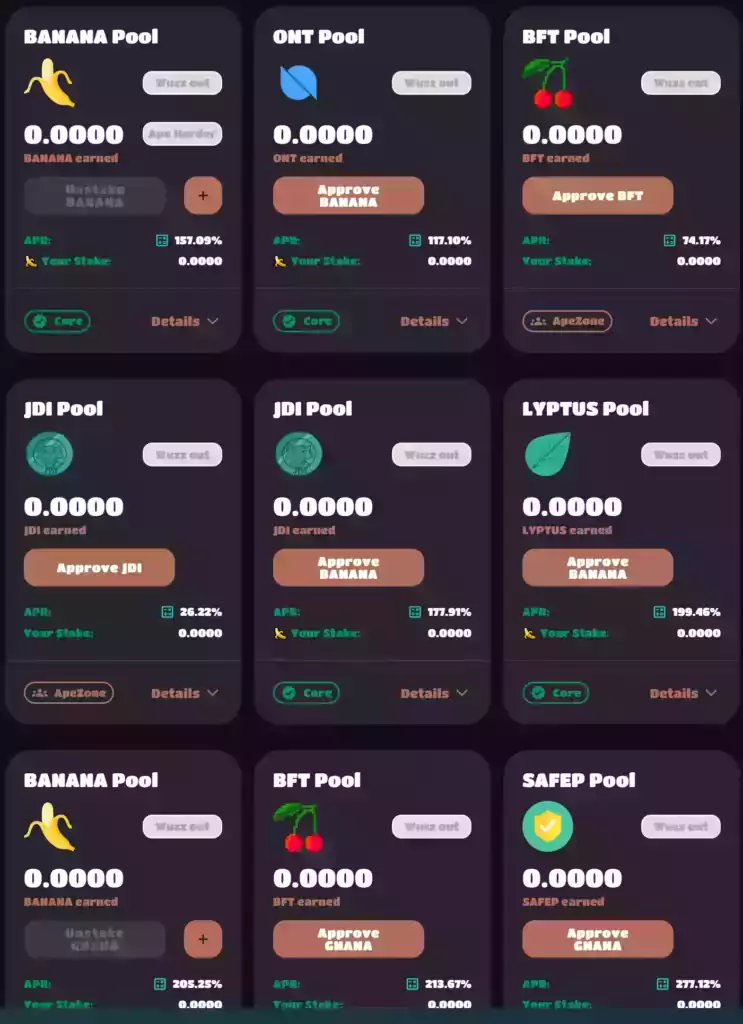

If you don’t want to face the risk of impermanent loss and the complexity of creating liquidity pairs there is a much simpler option available. You can simply stake BANANAs (and a select few other currencies for certain pools) and earn more of them or you can earn other types of currencies as a reward for your BANANA.

Here’s a look at the pools:

You can see the rates are not as high as farming but still quite respectable. It’s very simple with no liquidity pairing or anything. You just click the + and add them and you get the rewards.

I have used the pools but ended up moving everything into farming. They worked great and your balance immediately builds and accumulates just like with farming but I wanted to chase the higher yields. I may rebalance more later as the rates continue to adjust as more people continue to use the platform and the rates adjust to reflect the market which may make some things look more favorable than they looked when I wrote this article.

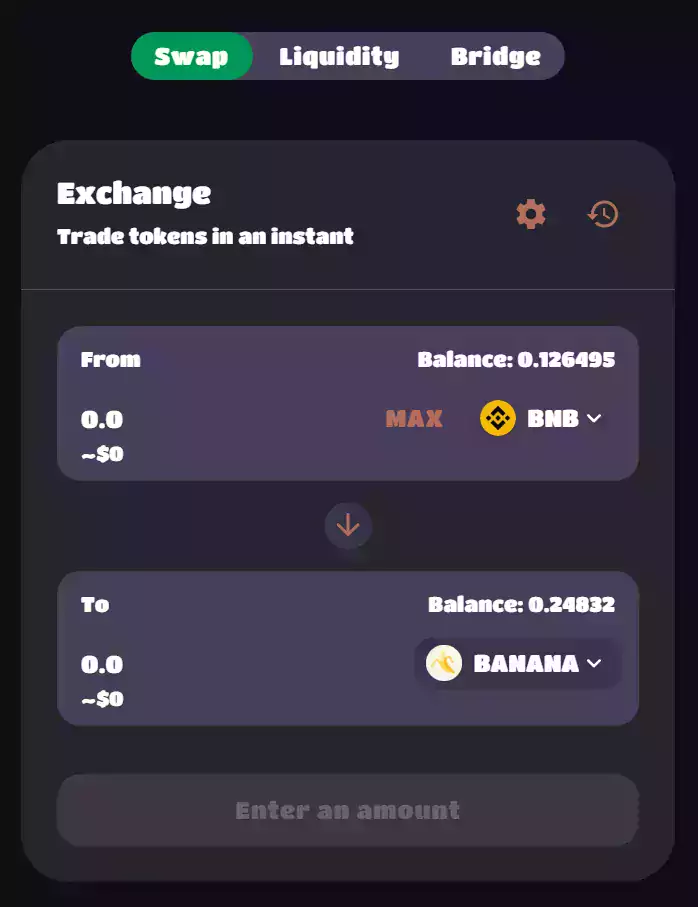

Swapping

Swapping tokens is easy, painless, and cheap. If you’ve ever used any other swapping service it works pretty much exactly the same:

They have a decent number of pairs including a lot of the competitor exchanges like CAKE, NUTS, and more. New pairs are being added all the time as well. Swaps are cheap and fast (< 30 seconds and I want to say like 10-20 cents in fees).

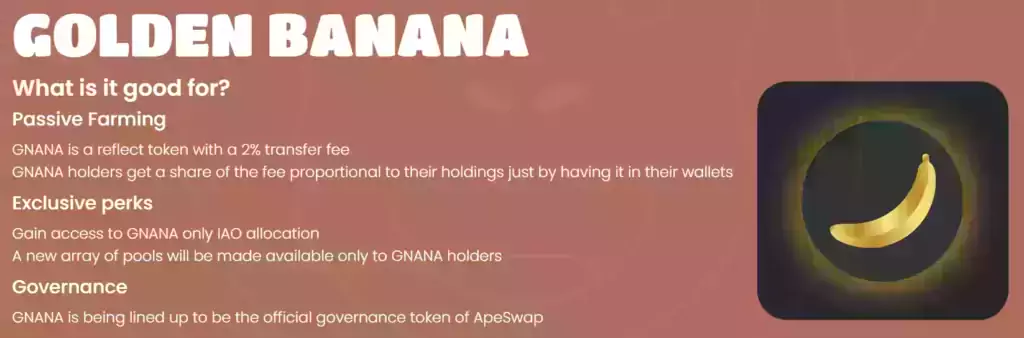

Golden Bananas (GNANA)

This is a really interesting feature that is unique to ApeSwap. Golden bananas are intended to be the governance token for ApeSwap and they have some really interesting properties:

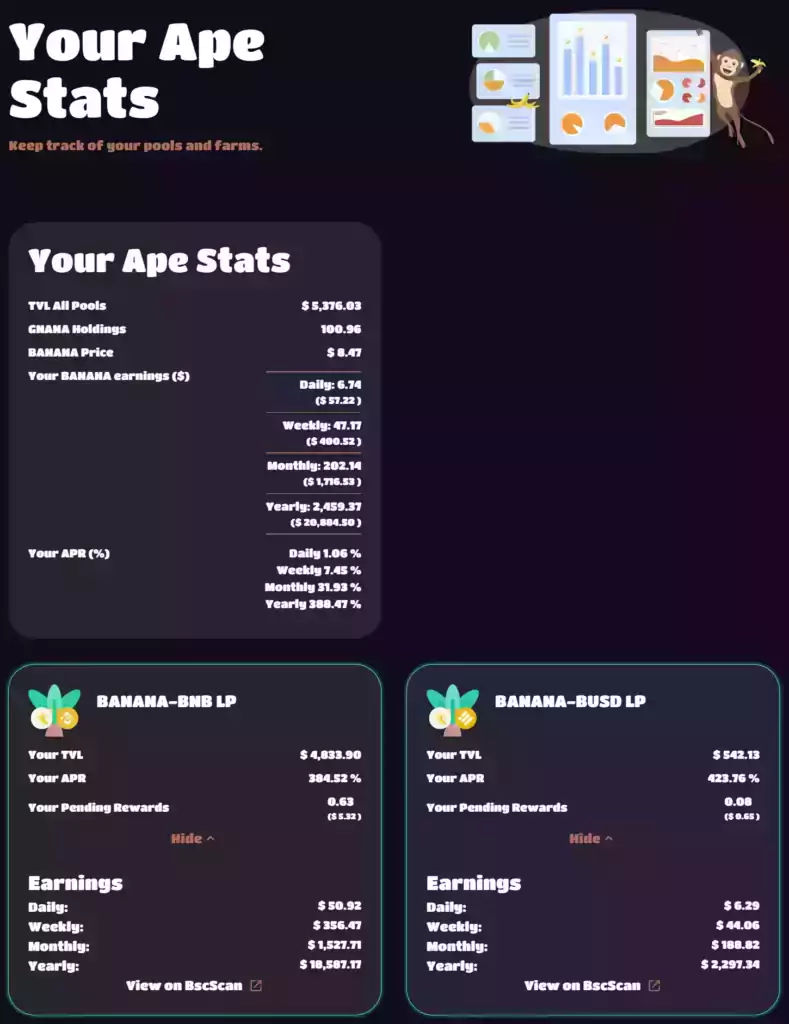

First, to get golden bananas you have to pay a 28% burn fee. You read that correctly, you have to burn 28% of your bananas (and a 2% reflect fee, more on that in a moment) to turn them into golden bananas. This is what it looks like:

This increases the value of the BANANA token by burning them. It also penalizes whales from moving in and out of GNANAs because of the insane 30% loss every time you move into GNANA.

The other awesome thing about GNANA is the 2% reflect fee. What does this mean? That means that when you have GNANA in your wallet (not staked) every time someone does a transaction they pay a 2% reflect fee that goes to all GNANA stakeholders and immediately increases your balance. That’s why my balance has all the extra #s after it. It’s constantly getting 2% fees from all GNANA transactions. I currently have mine unstaked to get the GNANA reflect fees.

You can also stake your GNANA into pools that pay much higher rates than the standard pools. At time of writing the GNANA staking pool for BANANA gave you 205% APR vs. 157% for the standard staking pool.

Eventually as the governance token you will likely be able to use GNANAs to vote on changes to the ApeSwap system like you can with other governance systems in other cryptos and I suspect future perks will continue to be added as well.

Reflect Fee Earnings

I have been running an experiment to see if it’s worth it to leave your GNANA unstaked and earn the 2% reflect fees that are paid out to all GNANA wallet balances (unstaked) for every single GNANA transaction. That means if a heavy hitter buys 1,000,000 GNANA they pay out 2% of that to all GNANA holders. It’s distributed to everyone based on their GNANA balance.

For this experiment I started with about 100 GNANA. Here’s the results so far:

- 12:50am 5/4/21 – 100.83692

- 2:22am 5/4/21 – 100.84059

- 2:40am 5/4/21 – 100.84076

- 2:49am 5/4/21 – 100.84448

- 10:59am 5/4/21 – 100.90658

- 12:23pm 5/4/21 – 100.914823

- 12:48pm 5/4/21 – 100.917236

- 12:56pm 5/4/21 – 100.918348

- 3:12pm 5/4/21 – 100.95683

- 5:46pm 5/4/21 – 100.97162

- 6:07pm 5/4/21 – 100.98609

- 6:40pm 5/4/21 – 100.98848

- 8:08pm 5/4/21 – 100.99374

- 8:29pm 5/4/21 – 100.99448

- 9:10pm 5/4/21 – 100.99519

- 10:28pm 5/4/21 – 101.01053

- 12:06am 5/5/21 – 101.02275

- 12:21am 5/5/21 – 101.02277

- 3:21am 5/5/21 – 101.03115

- 3:47am – 5/5/21 – 101.032747

- 11:40am – 5/5/21 – 101.05644

- 1:40pm – 5/5/21 – 101.06357

- 5:54pm – 5/5/21 – 101.09746

- 7:55pm – 5/5/21 – 101.15425

- 9:28pm – 5/5/21 – 101.16595

- 12:32am – 5/6/21 – 101.17390

- 1:48am – 5/6/21 – 101.17602

The results are pretty interesting. Notice from 2:24am to 2:40am it only went up .0002 that entire time for 18 minutes. There must have been virtually no GNANA activity at this time. I took one last measurement before bed at 2:49 and it had gone up a whole .004 all of the sudden. When I look at my readings during the higher volume periods of the day it’s increasing *much* more quickly on average. This seems like just luck as to whether people are doing big GNANA transactions.

My impression so far is that you’ll probably make more staking your GNANA in the 200%ish BANANA yielding pool right now vs. leaving it in your wallet for the 2% reflect fees but it’s hard to say. There were some pretty big jumps in my balance as I have been tracking it and if the volume continues to increase the 2% reflect fees may easily start passing the BANANA yield.

I’ll keep gathering data!

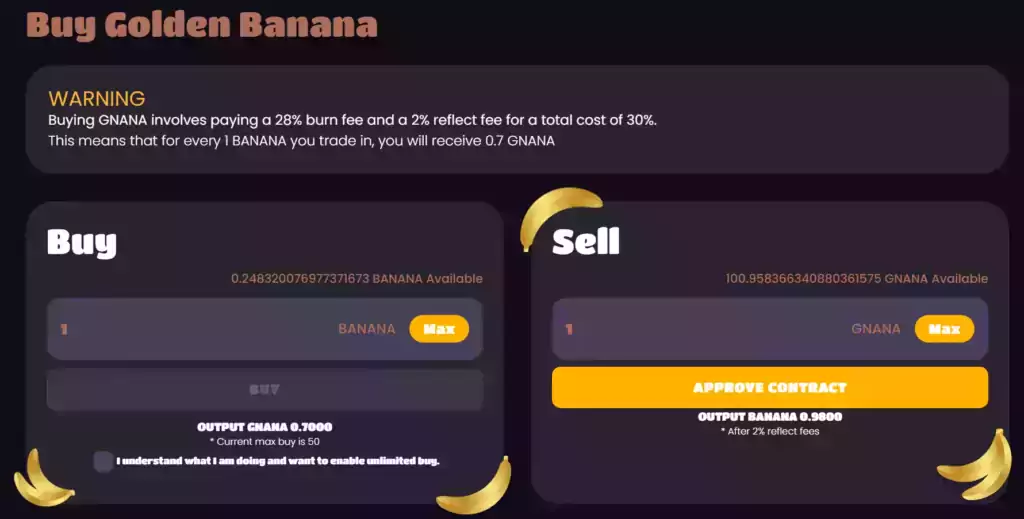

Farming Earnings

The coolest feature ApeSwap is their built in earnings estimates. It has pretty detailed built in calculations for all of your farming/staking pools that break down how much you’ll make per day/week/month/year.

Now, before I show you the numbers, take them with a massive grain of salt. I am. The rates are still quite high and will likely come down quite a bit as more liquidity is established on the exchange. Here we go:

The breakdown into cards for each pool is very nice. ApeSwap actually tells you the difference in earnings you’ll see between a 423% rate like BANANA-BUSD and a 384% rate via this calculator.

Frankly, these earnings are absolutely, wait for it, bananas. Will I still be farming this platform 1 year from now? I don’t know, I kind of doubt it but maybe. But for right now? Yeah, even around $5000 will net you $57 a day right now in the basic BANANA-BNB pool.

That’s absolutely wild performance, but I think the rates will continue to fall and make this less attractive. The further out the timeline the less accurate it likely is. Yesterday it said I was making $29,000/yr but BANANA was over $10 and it is $8.50 right now. At least at time of writing though, it really is making $56 a day in BANANA with about $5300 in liquidity provided. That is outstanding and too good to be true in my opinion but time will tell.

Conclusion

It’s really good so far. Several tokens have already done their initial token offering through ApeSwap and it continues to grow. Yields are great right now but will likely fall as more liquidity comes into the exchange but I’m having a blast doing it at the moment.

As much as I hate to say it, I really have enjoyed working with the Binance Smart Chain despite it’s evil centralized nature. I really am excited for cryptos with cheaper fees than Ethereum that are more decentralized to finally “catch up” and start offering some of these DeFi products on other platforms.

As far as ApeSwap, the web site is fast, works well and has features I love and am annoyed that other platforms don’t have when I use them now (such as the estimated earnings breakdown screen). We will see how their governance token continues to develop (GNANA) and what else they do in the future!

Great insights into ApeSwap! It’s refreshing to see a platform that not only offers quick and affordable swaps but also provides substantial yield farming opportunities with impressive APYs. The transparency and legitimacy highlighted in your review are crucial, especially in a space where scams are prevalent. For those interested in exploring DeFi further, platforms like TheCoinEarn offer additional resources and insights to navigate the crypto landscape safely and effectively. It’s essential to stay informed and cautious, and your review serves as a valuable guide for both newcomers and seasoned users.

I agree most projects that guarantee very high APY is a scam. The whales can remove all of the liquidity and the price will crash. I would like to know your opinion on some of the newer high APY cryptocurrencies that claim to have protection against this. Off the top of my head the most popular are Titano, Libero, and Safuu. I am especially interested in Safuu as it has the most clever tokenomics and has done really well lately. The CEO of Safuu was involved in several failed projects in the past, but he hides nothing and has probably the best AMAs I have ever seen. Do you think the features that protect the liquidity will be enough to prevent collapse in several months when the whales have millions?

Hey Will,

Thanks for commenting! Basically no, I don’t expect that to answer in the most straightforward way possible. I think it’s definitely possible to manage a lot of this through tokenomics but we’re still in the early stages of figuring that out completely. One project I followed pretty closely early on that has been pretty up and down on the charts is Luna (Terra) makes extensive use of this as a core principle of their design. This has built in tokenomics meant to help keep staking rewards high and more importantly to buy and sell fiat currencies against Luna and keep the funds balanced. Basically the tokenomics power the system but the system sometimes (often at this point in crypto history I would say) gets overwhelmed and breaks down.

From what I’ve seen when it’s built right into the tokenomics these systems work pretty well. Here’s the kicker though: every iteration I’ve seen can and will be overwhelmed at some point. This is what I expect to happen with these systems. They will hold up to a certain point but eventually it becomes too much and everything falls apart. This is essentially what happened with so many of these exchanges already / in the past. They all collapse for slightly different reasons but from a far away distance they all look really similar (like a house of cards falling apart).

I haven’t read all the specifics for these ones so they probably already have prepared answers to some of the questions I’m raising here. Those would be my concerns though and I would basically expect the same thing to happen until basically we have seen a system that can survive and actually live up to any type of protection against this. This is basically the first or second generation of this type of insurance/protection/whatever we want to call it (there’s varying ideas). Some of them will fail miserably and probably the best of them will probably not be perfect but show enough promise that the 3rd or 4th generations will actually give some real peace of mind at some point.

I’d basically be looking for a system that has withstood multiple serious liquidity events and came through it in once piece for at least several major events. It would be even better to see it hold up for a year or more (and not collapse, evaporate, fail to perform or pay out or whatever the specifics are of any specific type of insurance/protection/etc.).

I definitely want them to keep trying to do it though so I’m not discouraging them from trying. I think they will keep getting better and better at this but that it will result in there being less risk / the system will be more resilient but that we are pretty far from solving the problem completely where things are “safe”. There are definitely plenty of reasons to be skeptical though from history for sure and this could be 2 years away or 20 years away or more!

I am new here. Recently came upon Abiswap and would like to check if it is legit or a scam. Any advise is much appreciated. Thanks.

Hey Patrick,

There are 1000 scams for every 1 of these that is legit. Anyone can make one and just copy it and the source code for a lot of these sites has leaked / been passed around. Most of them are running very similar code.

ApeSwap is a huge and old exchange. If you go to the CoinGecko ratings here you will see that even with that reputation ApeSwap has a trust score of 6 and is ranked #188. It barely even makes the top 200 exchanges (although this is still a good score, this is just to give you some perspective on how many there are that are also reputable out there). PancakeSwap is up at #35 spot as a comparison. Ranking in the top 200 though is great!

Now let’s look at AbiSwap. What rank is it? I have no idea. It’s not even listed on CoinGecko. Further, when I type AbiSwap into Google, your comment is the #5 result already and you posted it yesterday. The #1 result also appears to be some Uniswap API or something. Is this a typo? Try it yourself and type “AbiSwap” into Google and you’re #5 already. That is *not* good if this is not a typo! It might be good for me if my site ranks so highly in crypto keywords that a comment is immediately the #5 result on Google the next day but that’s beside the point. You shouldn’t be able to rank this easily unless there’s no competition because this is not a real thing.

Frankly if it’s not on the first few pages of the CoinGecko site I linked to run away. You’re just gambling and wasting your money on a site that’s not even listed on CoinGecko let alone ranking.

Lots of people like to play with these kinds of exchanges. It’s pure gambling. This kind of DeFi user we call degenerates (DeFi degenerates). People came here trumpeting JaguarSwap and some other knock off nonsense like this doing the typical “oh I gained 2000% I’m making tons of money on JaguarSwap”.

Guess what happened? JaguarSwap is worth 3 cents each. They lost everything like they always do while they were arguing how awesome JaguarSwap was with me when it’s some garbage site that I could put one up just like it in 30 seconds. Anyone can. Crypto is absolutely FILLED with idiots like this who will defend these no-name sites because they bought in at some cheap price and “on paper” they’ve made some money (before it all goes wrong). It’s a story as old as crypto itself and has been happening the whole time with every coin.

Do they ever come back and admit they lost everything? Never. They disappear and you will never hear from them again because they’re losers and they’re going to go get scammed AGAIN chasing the same dreams without doing any research / putting in the work. These people are the same as the people you see at the casino betting and losing their house/rent money and other degenerate behavior. It’s exactly the same trap they are falling into, and the “house” knows it. This is a very old song and dance. It’s literally the point. From their perspective just you walking in the door means you’ve already signed up to give them money / be the sucker.

I think the main trap people fall in is they are newer to crypto and everyone thinks they stumble across some hidden secret or hidden gem. The big bad jamesachambers.com guy is just hating on it and doesn’t know about it and is missing out on all the money. Wrong. We’ve seen this movie literally 100,000,000 times before! We can tell you exactly what is going to happen and it’s not because we’re missing out on “GAINZ”. It’s because someone tries putting up another one of these sites every day. When you’ve been around for a while you start to completely ignore them because if they ever become anything useful we’ll hear about it / cover it. Well less than 1% of them do.

Crypto is absolutely full of “hidden gems”. It’s also the #1 marketing term you will get from every startup. Understand that people go through extreme effort to create the illusion of a hidden gem in crypto. This is what they are selling you to get you to buy in so you can make THEIR dreams come true, not yours. You are the “sucker” in that situation and it’s definitely not about you. It’s an art form and people have a decade of practice at making you believe this / making it look like this. They’re very good at it. The only way for you to be better is to set some rules for yourself, always verify everything on CoinGecko or other legitimate information sources and never waiver.

I never recommend it. If you can’t find it on CoinGecko along with a million people saying it’s legit you are absolutely going to get rugged / scammed so I highly recommend against it. Welcome to the site and hopefully that helps!

There is a good impermanent loss calculator named Impermanent Loss Calculator here

Hello James,

I have recently invested 1,000 USD in ApeSwap and being a complete beginner at BSC and DeFi, I am a bit confused about polls, farms, liquidity, swap, exchange, impermanent losses etc… For some reason (obviously some mismanagement my end) I also see that my funds were not allocated where I initially intended to.

I would therefore be interested in a one on one 1 hour zoom session in order to further my understanding as well as reallocate my funds in a sensible way.

Would that be something you would be willing to provide ? If yes at what price and how can we set it up ?

Thank you in advance.

Kind regards.

Hey DrDelay,

Welcome! So this is actually part of my big deep dive to learn DeFi and I am by no means an expert on how to allocate your funds. I’m still learning this all myself and would feel terrible taking money to give someone else advice on this aspect of it. I’m very experienced in cryptocurrency but investing in DeFi safely and those kind of strategies etc. are definitely it’s own subculture and one I’m just barely jumping into.

From what you’re describing I would guess one of two things is happening: #1 is that the funds that aren’t allocated the way you expected and have changed are probably in liquidity “farms” which fluctuate and give you different amounts of coins when you pull them out (that’s the impermanent loss part). #2 is that you put funds into one of the new pools that doesn’t always show up in the “Liquidity” section. If that is the case you can “Import” it by using the link on the page and put in the contract address for the coin you want to put in (I usually find them by typing in google something like “banana coin contract” which the first hit will be BSCScan and has the contract address for the coin there). I had this issue with a few of the pools when they launched but after importing they always showed back up.

One thing to consider is just using the “Pools” while you’re learning. The pools are much more simple than the farms and will work the way you’re expecting. If you put funds in a pool and allocate them they won’t change (other than your rewards growing). The “Farms” change since you are actually pairing two things together like BNB and Bananas, but sometimes one goes up and one goes down or one goes way up and the other one only goes up a couple of percent and then you experience “impermanent loss”.

Sorry I couldn’t be of more help than more than a few vague tips but I wanted to be perfectly honest that I’m definitely not qualified on DeFi strategies yet and for sure am making a bunch of mistakes myself and learning from them. That has always been the way I have tried to learn it. I set a budget to try and learn with that I’m not afraid to lose. Maybe even $100 instead of $1000 until you’re comfortable. Once you’ve found a strategy you’re comfortable with it’s extremely easy to scale up to a more serious amount with a few clicks which is the beauty of DeFi. Hopefully it helps a little!

Hello James,

Thank you very much for your reply and most of all your honesty.

I agree with you on the fact that DeFi is a beast appart that requires research and deep understanding to be tackled properly.

I shall consider the pointers you gave me and see to what degree they match my situation.

For instance using the pools and a lower budget at the beginning seems to be the wisest path indeed.

Thanks again for your time and all the best.

Hey DeDelay,

No problem at all, thanks for your follow up! Sorry I don’t have more to offer than that but it definitely sounds like you’re on the right track to me with starting with a small budget in the pools and working your way up from there seems to be the safe way.

Hopefully by 2022 I’ll have learned enough to start writing about some actual strategies, that’s the goal at least. Best of luck to you and take care!

Excellent review. Thank you

Thanks for that!