One way I keep up with the developments in cryptocurrency is I do watch some of the YouTubers since the YouTubers are generally following the juiciest developments to farm views. With the continued news that Ethereum is going to launch Eth 2.0 and is more or less on time (now called the “Ethereum consensus layer”, how catchy) how much denial there is around this fact.

Except we are way past that point now. It’s literally these YouTuber’s job to know that GPU mining is toast and today I’m going to expose how big of frauds they are, how they really built their mining farms, what they are actually doing vs. what they’re telling you and why, as well as explain what exactly is going on with Ethereum and why if you’re planning on being able to mine with those GPUs (at least above the cost of your electricity / profitably) the math is not looking good.

Why am I doing this? Because I’ve been mining since before Ethereum existed and will still be mining after Ethereum mining no longer exists so it’s pretty clear to me what is happening here.

Let’s break down what both the miners AND the Ethereum developers/community don’t seem to want to remember so we can actually understand what is happening (and when) and break it down!

Ethereum Mining Ending

Let’s start with the elephant in the room. Is Ethereum mining ending? Yes, not only is it ending, they have been trying to end it almost since Ethereum started. Within 2-3 of years it had already been decided this was going to happen.

Look at this EIP (Ethereum Improvement Proposal) from all the way back in December 2016 where it was already a foregone conclusion it was going to proof of stake: Official Ethereum EIP #186 – GitHub.

That was several difficulty bombs ago. The block reward was 5 ETH per block back then!

The Beacon Chain

Now you might say “okay, so they’ve wanted to end it forever and it hasn’t happened, so why shouldn’t we assume that it will never happen or take 5 more years”?

Excellent question! It’s because now Ethereum 2.0 / Ethereum consensus layer already exists. It’s not theoretical anymore. There’s no question it will work. It is working / has been working for a while.

It’s called the “Beacon Chain”. It’s a separate network from Ethereum 1.0 but it already exists today. You can already run a validator node and you can even send Ethereum to the chain and stake it for pathetic rewards vs. mining it gives with even mediocre hardware.

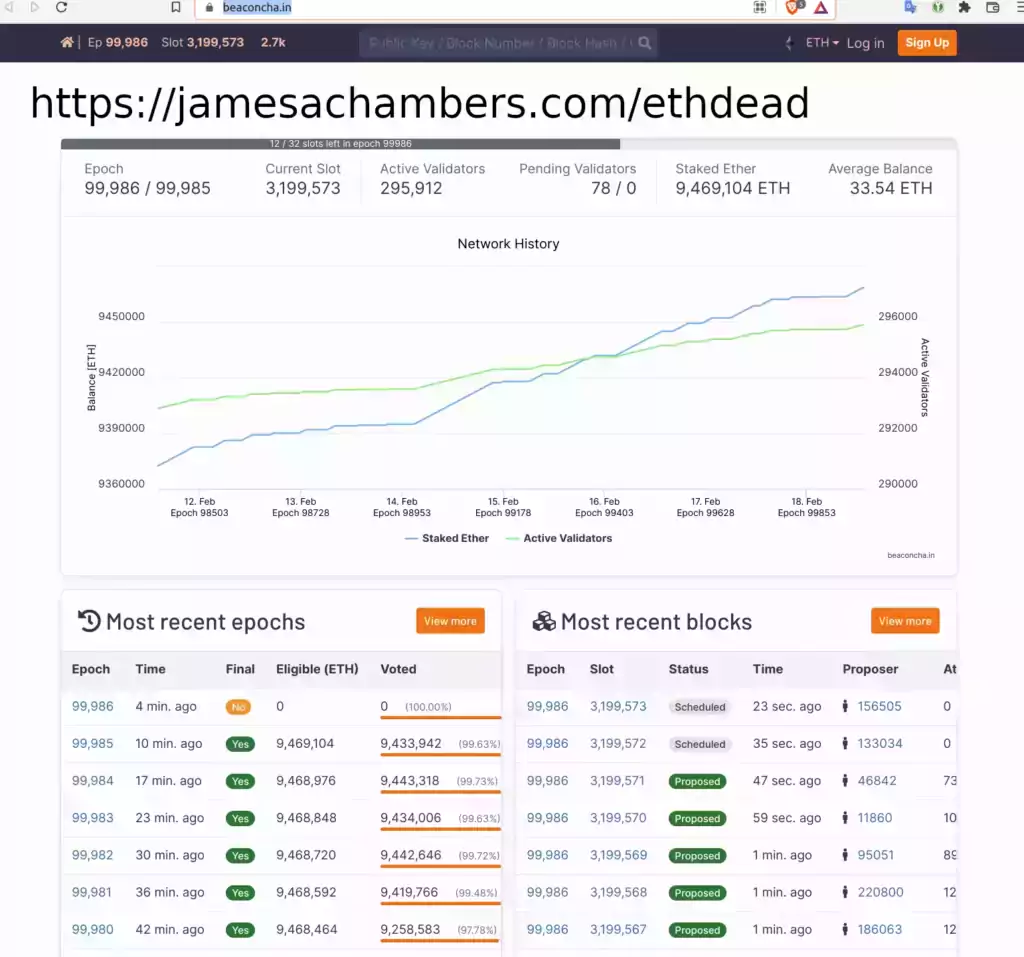

Seeing is believing. If you want to see the Ethereum 2.0 chain working we can use the block explorer from beaconcha.in like this:

It was launched all the way back on December 1st, 2020. This was when the Ethereum bubble was starting and after I’d bought the last GPUs I’d ever buy for mining (5x RX5700 XTs for $400/ea in early November before the price went 1k+) and started buying ASICs and have been ever since.

The Merger

So what’s left? All that is left is for them to merge Ethereum 1.0 with the Beacon chain. That is it. It’s already working. They aren’t still making it.

Right now they are planning. They want to make sure the transition goes as smooth as possible. If things went really badly it would impact the value of Ethereum and create potentially countless really serious problems / headaches for people.

They could move it today if they wanted. They really could. Think that’s a stretch? How could you possibly know that James?

The 51% Attack Threat Fiasco

Despite all of the denial back when the miners first heard about this they threatened a 51% attack. This is where miners group together to achieve greater than 50% hashpower on the coin. This allows them to start screwing with blocks as they have enough miners to make this possible.

Why? Because they are morons basically. The gas fees were hugely cut for miners and most of it is burned now. It was called EIP-1559.

It wasn’t all of us (it was a lot of the sponsored miners we’ll be talking about later though). In fact I was warning it would kill mining. And guess what? I was probably right. Look at me vs. reddit here: Reddit EtherMining Subreddit “Show of Force” Discussion

My argument was that the “Show of Force” 51% mining attack was lame and counterproductive. Want to guess how that went?

They got absolutely trounced so bad that they don’t even speak of it anymore. Vitalik Buterin presented a plan to IMMEDIATELY move Ethereum 1.0 to the Beacon chain if the miners performed a 51% attack. Were they actually ready then? Probably not, there would have been a lot of problems. They have had a year to prepare since then and they already thought they could mostly do it. That’s how you know.

If you weren’t around when this happened you may have never even heard of this. That is because it went as badly as we told them it would if not worse, and guess what? It actually does look like it’s going to mostly kill mining, and it’s *definitely* going to kill GPU mining. Even just the threat of it. It doesn’t matter that they didn’t actually perform a 51% attack.

They forced the Ethereum team into a difficult position using what they must see as weaknesses/mistakes in the past. All of the major new competitors in this last bull run were Eth-killers that already were using proof of stake and had way, way lower fees which are atrocious on Ethereum to this day. The fees are literally the worst of any cryptocurrency in the world and maybe even more expensive fees than any financial product that has ever been created on Earth. Already being proof-of-stake meant they were immune to this threat the miners were making which was making them look even more like punks against their fiercest competitors that legitimately want them dead (Eth killers). This was going to trigger their wrath.

They don’t want to talk about it because it literally advanced the timetable. They cut off their own foot. This would not be happening as soon as it is going to if this didn’t happen and create a legitimate threat that spooked Ethereum holders/investors forcing Vitalik to respond.

If we had just had a little bit more time NVIDIA was heavily making more efficient GPUs for mining that used much less power. Things didn’t have to be this way. The miners honestly forced a lot of this by being such greedy short-sighted idiots as most of them are (which is why they usually go bankrupt when the bubble is over).

This last Ethereum mining bubble was so large that most of them got away jumping in late and buying GPUs at 5x prices. In 2017 they all went bankrupt and we went in to a 3 year bear market. They’ll just get left behind on ASICs and frankly they already have if they haven’t started building their ASIC farm already.

The Current Situation

Okay, now that we’ve covered the history that neither the miners or Ethereum developers want to talk about we have enough background to explain what is actually going on here with mining. Let’s divide the miners into two groups:

- #1 – Old miners – Likely believe in decentralization and are most idealist about crypto, probably have mined other things than Ethereum before, have survived multiple bubbles, will tell you honestly if they think something is good/bad to mine as they’re experienced enough to know more people/attention to a coin actually does benefit them financially directly. Probably less than 10% of miners qualify in this climate.

- #2 – Almost everyone else – Started mining in the middle of the Ethereum bubble and buying GPUs — were successful because of the magnitude of the Ethereum bubble but would not normally have been — not likely to care about decentralization or possibly even know what it is in some cases — some of them will survive and join the “old miners” club if they can survive a bubble or two bursting and not be gone — not necessarily evil but are naive/inexperienced and super prone to greed or they wouldn’t have jumped in during the middle of a bubble at 5x prices

But wait, there’s a third category I wanted to talk to you about today.

- #3 Sponsored miners – People who received most or all of their GPUs for free during the Ethereum bubble by starting a YouTube channel to review GPUs for mining. Have never survived a bubble. Probably haven’t been mining for more than a few years at most. Did not build their farm the way they teach you. Their purpose is (was, we’ll get into it) to sell you GPUs one at a time and tell you to build their farm that way even though they didn’t and never will. This is what they’re still doing because they aren’t actually successful miners and that is all they know how to do. They’re sponsored grifters.

Sponsored Miners

I’m not sure that most people realize this. All those YouTube cryptocurrency stars? Those are not successful or even real miners. They did not buy most of those GPUs, and they definitely didn’t build their farms the way they are telling you to. That’s all sponsored gear. You definitely don’t want their advice on how to actually build a profitable farm if you, for instance, actually have to buy your gear with your own money because they didn’t. They have no idea.

What happened was when the bubble started the GPU sales went absolutely off the charts. GPU launches were the biggest thing ever. Now people largely ignore them because the availability is so poor it doesn’t mean anything unless you’re an insider. As a result of this GPU vendors started raising their prices and really wanted to cash in on this phenomena.

NVIDIA started making GPUs that were more power efficient just for mining. That’s how much these companies wanted a piece. They also started sponsoring YouTubers. Just like YouTubers that review GPUs for gaming there started to be YouTubers who covered crypto mining that started to be sent free GPUs for the exact same reason. To sell more GPUs through influencers. That is where this class of “miner” was born.

You know who I’m talking about. The people with giant towers of GPUs behind them with all the RGB lit up basically screaming “look at how badass of a miner I am”. That’s your grifters right there. Guess where they got those? Most of them came from NVIDIA, EVGA, Gigabyte, every GPU vendor you can imagine.

What happened was all of these YouTubers realized that since the companies were trying to cash in on this phenomena there was an opportunity. It wasn’t mining though, not really, and definitely not the way they are preaching to their audience pretending they are building these farms 1 GPU at a time with their hard earned money like they’re telling their audiences. They smelled a grift and they started up their channel. Take it from another content creator but one with very different audiences / motivations.

Why Sponsored Miners Recommend GPUs STILL

There’s a few reasons. The first one I touched on already which is that that has always been their job. They got a bunch of free sponsored GPUs to build a poser farm with and look like they’re some kind of badass on YouTube. That’s all they are. They didn’t build that farm actually buying them like a real miner has to. How it worked is they would get a 3070 from NVIDIA, then a 3070 from ASUS, then a 3070 from Gigabyte, and so on. Then the 3060 came out and they would do it again!

Because of that they don’t actually know anything. Some of them might legitimately not know / understand that GPU mining is ending and that these other coins couldn’t even absorb a small fraction of Ethereum’s hashrate and remain profitable. The closer we get though the lower the chances are that is the case, and they’re getting quite low which is why I’m writing this now. Too low.

The explanation is really simple. The “Eth Mining isn’t ending / GPU mining isn’t ending” denial group is very passionate about what they are saying. They need a constant drip of reinforcement to maintain this illusion. Wait until you see the numbers, and then you will understand why. They’re absolutely soul-crushing.

What do YouTubers specialize in? Making content and ultimately driving clicks about things that piss people off. It’s usually controversial topics. Topics where people will subscribe and come back so you can drip-feed them the same nonsense are the most lucrative of all. That is the “grift”. People do it in almost every topic/category and this one is even better because it also has free merchandise you get to keep from the vendors.

Could you succeed at GPU mining with dozens of free GPUs during a silicon shortage?

That’s why these guys are *NOT* successful miners. Are you kidding me? Can you imagine being handed literally dozens of NVIDIA 3000 series GPU during the biggest Ethereum bubble in history AND a silicon shortage? How could you lose? That is literally a gift of hundreds of thousands of dollars between the ETH mined and the GPUs themselves.

Do you think that person has something to teach you about mining? Why? They don’t even know as much as you do. If you had to buy your equipment you are a better and more successful miner than they are. They aren’t miners. They’re sponsored performers with literally free gear, DOZENS of GPUs. They’re circus performers generating clicks from the build in their background and the brand names on them which was an investment by the manufacturer into that YouTuber at YOUR expense (you are the target to go buy the GPU and make the manufacturer money).

In fact, it’s even worse than that. They know they are lying to you AND you are buying them their ASIC miners with the money. Why? Because ASIC miners are *much* more difficult to get for free. You’re going to get at best one of the smaller models from each manufacturer or if you’re really lucky you might get something like a KD5/KD6 on occasion is as good as it could possibly get. You’re not going to get dozens of them. They need money. A lot of money, and there’s not much time.

They’re also *way* more expensive than GPUs. Too expensive for these guys even if they haven’t managed their money very wisely. They aren’t getting crazy money from the Ethereum anymore, nobody really is that isn’t using ASICs because they’re way more efficient and powerful. They probably paid way too much for those ASICs too because of the Eth bubble but the smart ones are doing fine.

That means they need you to buy them. The one free vendor ASIC is not even going to impress an average YouTube user. Buying 5-6 more of them is going to be a problem both because of availability and price. The GPU grift is all dried up. They’ll never receive another free GPU again. That time has passed and the manufacturers weren’t sending them to the mining YouTubers because they like them.

Don’t Be Fooled

Now let’s put it all together. We’ve covered the actual state and progress of the Ethereum chain merge that will eliminate Ethereum mining. We’ve covered the motivations of the people you are most likely to get crypto information from. Now let’s put it all together.

The GPU mining content in the year 2022 is so YOU can pay for their ASICs which the vendors will never send them enough of to even pose with on YouTube. Why? Because if they don’t get some ASICs fast they are not going to have a YouTube channel in 6 months. That is no joke.

They have a limited amount of time left to milk those GPUs before most of you still watching that trash will finally wake up and realize GPU mining is toast. They probably haven’t been managing their funds wisely and thought the grift could continue but they know it now.

Mark my words, it is that very moment when those of you remaining accept that Ethereum mining is ending when… SURPRISE! All of the sudden that YouTuber who has been doing knowingly dishonest GPU mining content pretending they are building these farms 1 GPU at a time like they’re telling the viewer?

They have a ton of ASIC content now paid for with your profits from needing to consume a constant drip of soothing saying it’s okay we will mine other coins blah blah blah. No. You won’t. The numbers do not support that conclusion.

Why GPU mining can’t absorb Ethereum’s hash rate

Name a GPU mineable coin. You said Ravencoin didn’t you. Everyone always says Ravencoin when I ask that question!

It’s basically the same as it has been for the past few years. I’m going to show you, but brace yourselves.

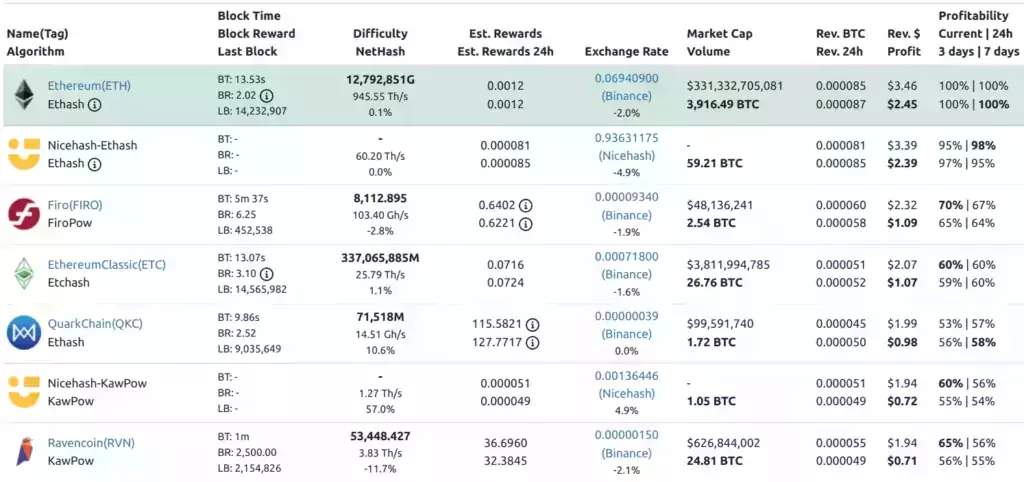

Let’s start with Ethereum Classic. GPU miners hoping to utilize this coin have a problem. It uses Ethash, the same as Ethereum, and there are ASICs for that. Those ASICs can’t mine anything else. They *HAVE* to mine Ethereum Classic or another Ethash coin of which there are some but they’re even tinier than the ones we’ll be comparing here.

What does that mean? It means since they have to mine Ethereum Classic and can’t mine the other coins the GPUs can you can scratch that one off your list. The ASICs are way more efficient than your GPUs that are also going to be homeless when Ethereum mining ends. You will not be able to compete here. It unfortunately also has by far the highest market cap of any of them of 3.8 billion.

Ethereum’s market cap is 331 billion. Let’s calculate that as a percentage to get a sense of how big Eth Classic is vs. Eth:

(3811994785 ÷ 331332705081) * 100 = 1.15%

Ok. That’s not good. Ethereum Classic, as BY FAR the biggest coin other than Ethereum that is GPU mineable, has 1.5% the market cap of Ethereum.

What happens when however many % of those people try to keep GPU mining or have to mine with their Ethash ASICs have to share a pie that is 1.15% the size of what they were getting before? They starve. You don’t make electricity. There aren’t enough daily emissions to feed you all.

Does it help if we do the calculations by hash rate? No, and they’re a lot harder to compare because a TH of hashpower on Ethash is not the same as on another coin/algorithm. You can do it though, and it scales pretty similarly to the market cap. The bigger factor will be whether there are ASICs on them because you can’t compete with the newer ASICs (9.5 GH/s in a single Bitmain ASIC, ONE!).

But what about those other coins?

We just did the biggest one and we are at 1.15% of Ethereum’s market cap. If you add them all together you won’t even break double digits. There’s nowhere to go, there’s no money in there literally. Not even if you add the entire market cap of the coins together can you find enough money for all these miners and have them make above the cost of electricity.

The fact is there are no other coins. Proof of Work is unfashionable now. Elon Musk will tweet saying you’re destroying the planet. Ethereum is feeding into this as well by touting how they’re getting rid of evil energy consuming mining to go to proof of stake. This makes all the other coins left behind on Proof of Stake look bad and no new project wants to be accused of that.

I just showed you the menu. Either 99% of both ASIC and GPU miners need to quit mining forever or you need to understand that you will be sharing from a pie that is 1-2% the size of Ethereum. Just Ethereum by itself. You also have ASICs that will be homeless that you will be competing with for Ethash (Eth Classic basically), which is by far your biggest choice.

Conclusion

If you want to keep mining then prepare. You’re going to need ASICs and / or Helium hotspots. There is no other choice as having no proof of work coins (at least that are in the spotlight) for so many years has left the landscape pretty barren. CPU mining hasn’t been profitable for years. If you think a type of mining can’t just go unprofitable and basically die then look at CPU mining, GPU mining is next.

If you want to ride out into the sunset then that is what you should do. Use what you have and keep it all as profit. Buying GPUs is only lining pockets at this point and it won’t be your pockets. Even if Ethereum mining goes on for longer than the end of the year (it won’t) the big boy ASICs from Bitmain that are 9.5GH/s will keep shipping and keep stomping on your GPUs until it’s not even worth the electricity.

Even at today’s numbers if you stopped mining Ethereum you’d be making about 60-70%. That is literally competing against nobody you already lose at least 30-40% of everything you make switching when nobody else even is. It’s going to be absolutely devastating.

What do you think about Chia Network (XCH)? It’s the most decentralized Blockchain with over 350.000 nodes ran by a high percentage of small farmers. PoST could easily be the future of crypto decentralization.

Hey Vefiar,

Welcome! I have given Chia a try before. I plotted a bunch of them on my servers. There were definitely some issues with it back in the day but I wonder if those have been resolved now.

The biggest issue when I was last doing it was that there was no pool support. There was an unofficial way to pool but it was super sketchy. I checked to see if they finally had pool support and it looks like they just barely did come out with pool support in January!

I haven’t tried it with the pools. Is it a lot better? It was so difficult to compete when it was purely solo mining. This was at least like 6 months ago or even longer that I last was doing it and I *never* did find a block after a few months and I stopped. I did intend to try again once pool support arrived.

My understanding is my old plots are no good (at least that was what they were telling us all the way back then, unless they found a way to resolve that and keep your old plots). Either way, I don’t CPU mine on my Monero rigs so when I was plotting I would have them plot to a NVMe drive while mining. I’m sure this is still what I would do to replot / start plotting again.

Have you been doing it with the pool support? That’s a significant and positive development for Chia mining and a long time coming! I always liked the idea of it but got nowhere solo mining. I may have to give it another try here now that the pool support is added!

Hey, official pool support was introduced in early July and it’s been working flawlessly since then. I also started plotting before pooling support, so about half of my plots are being farmed through an unofficial OG pool (foxypool.io) and the other half are NFT (pool) plots so I can farm them with any of the available official pools (there are a ton, usually with fees between 0 and 1%). The last week’s I’ve been slowly replotting my OG plots to NFT pool compatible plots, but I’m not in a hurry because foxypool works really well. In the last months there have been very exciting development milestones from the Chia team, like truly peer to peer exchange capabilities and CAT support (Chia tokens, equivalent to the tokes that use the ETH network). I recommend you the Chia Plot website to follow the Chia news (I’m not affiliated to it).

Hey Vafiar,

That’s excellent! I will definitely check it out and give it a try. I’d love to cover it on the site as I am sure a lot of people stopped mining that didn’t find blocks like I did. I don’t give up easily either, the numbers were just really tough back then. It even had the counter of how many years it would take for you to find a block (statistically speaking).

Pool availability sounds great. That was actually going to be my next question was how many pools were there. The other improvements sound pretty interesting as well. CAT tokens are a smart move. It definitely creates ecosystems within the ecosystems greatly extending the utility for everyone.

I’ll definitely check it out as I had even bought a few drive cages and things like that to use for it that never got ROI’d. With pooling support it won’t really cost me anything to just turn on the drives (or at least not very much). Thanks for the information!

Nice, I’d be great to read an article about it. The ROI for Chia farmers isn’t great right now with the current XCH prices, but the strengths of the project are the little power consumption and that no one needs specialized hardware to farm it (anyone can buy a big ass HDD without having to deal with scalpers). Also all the paranoia with killings SSDs turned out to be an overstatement: you can find people in Reddit that went over 3x or 4x the TBW life of their SSDs and they still work fine, and also the newest plotter implementations reduce the SSD writes up to 75% by using RAM for most operations.

Hey Vefiar,

That all sounds right to me. I do a lot of storage benchmarking on Raspberry Pi (one of my sites is Pi Benchmarks) so I definitely have some experience with storage.

Even rewriting images constantly for testing on my NVMe drives (where 10 minutes later I’ll write another updated image to it) I’ve never managed to kill one. That’s not to say it’s impossible, it’s not and one day one will die but it really takes a lot (more than it’s rated for). The manufacturer rates it like that because if the drives don’t last at least that long it creates some problems for them so it’s usually a conservative rating.

I’m guessing the ROI is going to depend a lot on if you are buying gear. I’m not sure how big you have to be to make anything but I’m very interested in looking into it. For me this was utilizing hardware and old drives I had laying around. I just needed the cages / cables / etc. to interface them with the server. I imagine there’s other people in this situation where if you have hardware that can do it that isn’t being used maybe it makes the math a little bit more attractive.

I did some quick math and it looks something like (from the Chia calculator) for 100 plots (about 10TB) you’d make about 20 cents a day or $6.16 a month. That’s not nothing actually and I think I had like at least 170-180 plots before pretty comfortably without having to buy any additional storage yet (but maybe getting closeish). 180 plots would bump it up to 36 cents a day and $11.09 a month.

36 cents a day for turning on some drives on an already operating server sounds like a win. It would probably cover not only the Chia mining but the rest of the server’s daily power costs. Since the server isn’t mining I suppose I am paying it now and I think Chia should start paying it to test things out!

Which Asic mining do you suggest? Stick to BTC?

Hey Jstall,

Great question! ASIC mining is pretty tricky. I’ll definitely explain what I have been doing and why. Right now I have:

The KD-Boxes make about $8.53 each. Those two combined make almost as much as my 500MH of Ethereum mining is down to (something like just under $20 a day). Unfortunately they cost about 2x as much as a scalped 3090 (roughly 4000-5000, probably more off eBay). They do use less than 200W of power though. All of them are profitable at the moment except the LBRY miners (not recommended for sure to get these ones at the moment). The ST-Boxes have absolutely saved me during the downturn.

Basically none of them are super, super profitable except the KD boxes right now but it’s a perfect time to start paying for them during the downturn. They’ll pay for themselves about a dollar a day at a time and not make anything too crazy during this period. This is exactly how Ethereum mining was for 3 years until there was a bull market. You spend a lot of time paying this stuff on paper but when the bubbles come you will honestly be made whole within about a week! You also may have to survive a long time and just slowly pay them off.

Why did I pick smaller units instead of bigger units? A couple of reasons. They’re easier to sell one at a time during a bubble than to try and sell a big unit. People will buy these on eBay like crazy. The main reason though is that I have 30 solar panels on the roof. One of my secrets to surviving these bear markets is that solar. All of the numbers on asicminervalue? You can basically subtract the electric cost out of there or at least most of it.

That *really really* helps during bear markets. A lot of miners will drop right to or even below the cost of electricity when it’s really bad. The ST-Box also only uses 60W. BTC ASICs are still great but you need to get a very efficient model. By having the solar take off this pressure it allows the miners to keep paying for themselves slowly during the bad times so they’re paid for and ready to profit when the good times finally come again.

You don’t want to try to do old S9 mining or anything like that. If you got a S19 or something like that then absolutely or one of the other efficient BTC ASICs. Then BTC is still a great choice with efficient hardware.

It’s a great question and the answer will be a little different for everyone. That’s some of the things I considered though for mine. Hopefully that helps!

We have 22 S19j ASICs we bought at $40-54 per t/h. We have 8 3000 series Nvidia GPUs we got 10% over msrp. We are looking to diversify and reinvest in miners while the market trades sideways/down. We have not owned Goldshells yet and are a bit afraid to buy used.

Hey Jstall,

I recently did a security audit that I haven’t been able to publish yet. I’m doing vendor disclosures to Goldshell, Avalon, InnoSilicon and Jingle Mining / JasMiner. I actually got CVE #s to publish these vulnerabilities. For what it is worth, Goldshell is the only company that responded so far. The other companies have completely ignored me so far which means I will probably be forced to do full disclosure as 0-days if I can’t get them to respond.

This includes RCE for InnoSilicon (authentication required) which I don’t think people have ever had before. You can root your InnoSilicons with my vulnerabilities I’ll be publishing and I don’t think they’ve allowed SSH for years (similar to AntMiner). In a few weeks you guys will probably see a bunch of CVEs come out for miners all at once and yes that was me, and it will be published here.

Not only did Goldshell respond, they gave me a SC Box as a reward! I did not ask them for anything (that can be considered blackmail in a lot of places). It was purely their decision. Right now they are preparing security patches. This has been an eye-opening experience for sure. I’m very surprised InnoSilicon didn’t respond. Goldshell had the only thing resembling an appropriate security response / any hint of caring about their customers.

The only pitfall I could see you running into at your scale is the recovery images for the Goldshells. I actually wrote an article here on this that has some of the recovery images: Goldshell BOX ASIC Miner Firmware Recovery Guide. They will send you these within probably 24-36 hours of your support ticket but I do wish they would post them publicly. You will be used to just downloading an image from AntMiner’s site and flash the miner with a SD card coming from AntMiner (I was). Just to be clear the firmware *updates* are publicly posted. This is only for if the miner bricks basically (happened to me twice and it was during firmware upgrades I was already doing out of 25 miners I upgraded).

You could probably even just do a support ticket or talk to their sales and say “we need the recovery image for all of our models right off the bat or we’re not buying them” and that would probably get you them (they don’t seem to guard them too closely, they just don’t post them in public).

I think the units are really great so far. I haven’t had any failures and their support responds to me within 24 hours whenever there’s a problem. That’s just for what it’s worth.

I have some links to Goldshells on here that go to AliExpress. Those are the same sellers that I bought some of my Goldshells from (most of them actually) because it was actually the cheapest. I paid with PayPal + Visa Platinum + they were eligible for AliExpress protection (similar to Amazon buyer protection). This essentially gave me 3 parties that said they would give me my money back if anything went wrong. Nobody tried anything (they can see what you pay with) even on some of the sketchier sellers who at worst let the order expire without shipping (automatically refunded after a certain amount of time unless you extend to give the seller more time).

They ship them from China but you still get them in about 7-10 days and it saved me hundreds (each) over eBay or Amazon or any western company really. Buying it directly with crypto from Goldshell is the only way to get them cheaper but it’s really tough to get the popular ones. You may have some vendor connections that can help with this but maybe they aren’t that familiar with Goldshell yet.

You might be interested to know they do have great bulk management tools though. Just like with your S19js (and you may be even doing the cloud stuff with AntMiner depending on how you guys wanted to set up) the Goldshell has both software tools and they recently added cloud support for it. I covered this here if you want to see what bulk Goldshells in your farm would look like: Bulk Management of Multiple Goldshell ASIC Miners w/ Yotta BC

They’ve definitely improved a lot. The older firmware didn’t seem to be very good. With my security disclosures they will probably be the most secure ASICs on the market other than AntMiner (who has the most experience with security for sure).

If you can get any of the Kadena ones they have been absolutely fantastic even during the downturn. Hopefully that helps!

You sharpened my perspective. Thank you

Thanks Alex!

Great article. I believe much of what you say is spot on. What’s your take on how miners can evolve? You mentioned helium, but that seems to be getting less profitable, too. How about MXC, or deeper network? Or maybe miners migrating to becoming validators by running nodes like Flux or Pocket? What’s your take on the next phase?

Hey Steve,

Thanks for commenting! I was worried some of my interactions from the early comments might scare some people from posting that I would fly off the handle or something. Usually my technology articles are non-controversial!

You’re right about Helium. My hotspot is down to about $3.98 per day now when it was originally about $35/day earlier last year when I first got the Bobcat (I want to say maybe May or Juneish?). The biggest problem is you can’t stack them all in the same location. I have another Nebra Outdoor hotspot that I got that I want to set up and replace my Bobcat. It’s tough with Helium though because to use the Bobcat I either need it to overlap with my existing hex and penalize me or find another placement for it. That’s not always easy!

The Deeper Network ones I hadn’t seen before. Those look really interesting. I guess I missed these because it looks like they do some Helium points too and I already have one too many of those for my house. What I find really interesting though is this.

That is a VPN gateway that apparently mines DPR tokens. That is really interesting!

The reason I think that the future will look more like this for mining is that the biggest problem right now is the Proof of Work consensus. It’s not sexy. Everyone accuses it of destroying a planet. If you are trying to launch a new coin it’s already so hard. You can’t overcome being accused of destroying the planet very easily when you are a tiny coin that nobody has ever heard of.

Things like Helium points and low powered devices such as these VPN gateways that mine completely shatter that line of thinking. A Helium hotspot uses something like 3-5W of power. The people’s laptop they are typing on complaining we are destroying the planet uses 10x that at a minimum. These little DPR ASICs / VPN gateways are similar with the highest one I can see only pulling 15W. That is fantastic. I kind of want one.

I’ll have to investigate the deeper ones a little bit more but they’re in stock on their store and only cost a few hundred dollars it looks like. I’m very tempted to try one although I haven’t checked on profitability. I definitely think you are right on the money though that the next phase is going to include devices like this that eliminate the power usage issue. We have to. Mining will keep shrinking if we don’t go in this direction and that’s mainly because no new projects can afford to take on the fight of being a high-energy consuming PoW coin (or are willing to).

So for validator nodes I was not at all impressed when I checked into them about a year ago. Things have dramatically improved. I checked Solanas here and it takes almost nothing to run one.

Wow, the 1.1 SOL per day is questionable but I’m guessing that’s an absolutely worst case. It requires almost nothing to start running one at least. When validator nodes first became a thing I investigated NRG (required several thousand NRG to run one) as well as the Ethereum one (notorious for requiring 32 ETH, that’s a lot of money).

Flux looks pretty reasonable to start one. Pocket I found this:

Now this is more like the validator nodes were when I originally investigated them a year ago. You need 15,051 POKT. I looked up how much that is and they are just under a dollar each. That means that one is a $15,000 commitment to even start running one.

I think these will be important for the next phase. They haven’t been important so far but it’s because the requirements have been so high. Flux, Solana, and some others though are offering *much* lower barriers of entry for running validator nodes.

I expect the requirements will continue to improve on a lot of coins especially as it becomes clear that when you have requirements like that it’s just going to make wealth centralization much worse. You’ve posted a few suggestions here I hadn’t looked at before that look really promising. The key is that everyone needs to be able to participate (like mining was supposed to work theoretically although ASICs and even GPUs have become a significantly expensive barrier). Hopefully that helps!

I ordered my Bobcat miner back in November and I’m still waiting. By the time I get it, it’s quite possible it might be down to $0.398 per day, lol.

Although I don’t run a flux node yet, I mine it at continually decreasing profitability. The parallel assets they award helped a little.

Presearch is a great project and I operate a node, but the node profitability is not very good. I am in it because it was inexpensive to get up and running, the potential of the project (I personally use it and really like it) and the future price of PRE.

I agree with you that the commitment for many of these nodes is often too much risk for the reward at this point. One concern that I have is that many so called “nodes” aren’t really even nodes. They are more like a ponzi scheme based on paying existing “node” operators with the investment from new “node” operators. There isn’t necessarily even a defined project.

Just to note, poket.network’s site does reference there is a node staking pool for POKT with no minimum, which is run on discord (not all that comfortable with that but it seems legit). The pool takes 15% of the profit from the nodes bought by the pool with the remainder being split in proportion to the node pool stakers’ investments . I’m not recommending it, I put a very small amount of money in to see how it works. But I’m thinking, if leaving it in the pool grows me to the point where I can do my own node for the whopping $19K it now costs, and the project still looks good by then… that might be an option.

There are a whole bunch of low powered miners popping up, but their coins are questionable, so I try to focus on projects. MXC Foundation (mxc.org) seems to be a fairly large IoT project but they make it difficult to take out your coins from the project at this point in time. Helium, has hopefully long term utility and hopefully HNT grows in value but I’m concerned as you mentioned, too, about future profitability. The other problem that I foresee with many, if not most, low powered miners is the risk that if the project fails… you’re stuck with a device you can’t use, resell or repurpose (although maybe that’s a business model for someone who can figure that out!). The other issues is that for most of these projects, your coins are pretty much in your account of the projects wallet… and not in your own hot or cold wallet.

I hadn’t seen that validator node for Solana, thanks , I will look into that one.

I think we are at a crossroads and although mining may not be realistic for those just starting, as W3 and the metaverse starts to take shape, I am hopeful that over the next 12 to 18 months we will see the next generation of ways that we can develop a sustainable “passive” crypto income on the blockchain.

Sorry for the long post, I used to write a lot and tend to get on my soapbox. I really enjoy your blog and your detailed approach.

Hey Steve,

Thanks for the additional info! You’ve definitely introduced me to quite a few things to check out as well. You are definitely looking at the right things here. Don’t sweat the super long post. I’m definitely really bad about that too!

The Helium chain seems to be evolving which should hopefully help. I did get on the waitlist for the FreedomFi 5G. It seems like Helium is also doing additional partnerships. This will hopefully breathe some life into the Helium ecosystem to keep the profitability sustainable. It’s still very hard to get the gear, but there is additional stuff coming out. Maybe Helium is going to become a whole IoT mining type of ecosystem ideally!

PlanetWatch is another one that came out recently. This is apparently an air sensor that monitors air pollution. They are trying to build a worldwide network. It seems to use Algorand (ALGO). A lot of people jumped in this but they said the profitability has been similarly dropping. It’s hard to say if this is related to the crypto market in general or is just saturation. It’s probably a bit of both.

One thing I don’t like about the look of PlanetWatch is it looks similar to trying to get a Helium miner if not worse. You have to buy a license and then get on the waitlist:

I did find this though that made me a little bit more interested. It looks like there is going to be 2 PlanetWatch Type 2 devices and one of them actually connects to Helium.

That is a lot more interesting to me as I trust Helium a lot more than these IoT startups. I know how to change HNT to the currencies I need which is a really big problem with newer projects. I’d love if it becomes a “thing” for more and more devices to piggyback off Helium instead of roll a new coin every time that is extremely difficult to exchange. It’s great for the token / ecosystem / device owners / everyone!

When it comes to the startups I’m careful like you are. You definitely need to be careful. I’ve seen some of these come out and go nowhere for sure. It’s exhausting to try to weed through all of the projects but I do try to do it every 6 months to a year or so at least to see if I can get in early on some of these that look legit. It’s legitimately almost a full-time job to research and keep up on it 100%!

For what it’s worth Helium at least seems to have mostly stabilized. It has been $4-$5ish for a while for me at least (obviously location and stuff can impact it a little). They have to be close on yours!

Thanks for the heads up about all of these projects!

You forget the real Ethereum force: miners around the world, small players with 1-10 gpus. They guard the system and make it safe. If ETH goes PoS then it will join the ADA, Solana and other youtube infected coins. The miners will get into the system guaranted to work in a democratic way, not the madeup numbers systems. Nobody knows what is going to happen, it is 50/50. But who will trust the guy (butterik) who burned few billions of shitcoins. PoS eth will turn into one huge bubble exactly the same as fiat banks. I belive in decentralization, based on small miners around the world. The new “ETH”will be PoW Asics-proof coin and this is going to emerge, once not all the nods will update to eth2. Hard fork.

I definitely believe that when Ethereum goes proof of stake the wealth will concentrate to the top extremely quickly. Mining was kind of an equalizer. It constantly redistributed the wealth. The new staking system will reward people with a whole lot of money who just park it!

Such a poorly written article. Go check and see if the ethereum team has frozen any code for the “merger”. It doesn’t seem like you understand the SDLC very well….

What are you talking about? Freezing code for the merger? Is this is a joke?

Here are the Ethereum developers. Literally looking for people to test code. In December.

Here’s his special instructions to connect. And test code.

Do you want me to link you to the GitHub code progress as well? Do you want me to literally show you code? Would you be able to read it / understand it anyway? Don’t worry, I’ll explain it to you.

There is the ENTIRE CONSENSUS PROJECT WITH CODE. Last release a few weeks ago. Constant updates. It’s code, but let’s be honest, you can’t read it.

The Bellatrix protocol upgrade is still actively in development. The exact specification has not been formally accepted as final and details are still subject to change.Background material:

An ethresear.ch post describing the basic mechanism of the CL+EL merge

ethereum.org high-level description of the CL+EL merge here

Specifications:

Beacon Chain changes

Bellatrix fork

Fork Choice changes

Validator additions

P2P Networking

I’ve got over a dozen GitHub projects spanning more than 15 years with code from all different languages. Go ahead and be caught off guard. I presented my evidence, you presented none like all haters have here. I literally have been watching the code, development progress, and all of that. Where’s your GitHub profile? What are your coding qualifications and project management qualifications? I just showed you mine.

It’s not that hard to find. Check out this. You’ll be able to read this one whether you can code or not.

I can go on, and on, and on about this. Notice how you posted so little? If I’m wrong then stop holding back. Post some details. I can go through the code with you. Any language. It doesn’t matter. I can walk you through it line by line and literally be a human translator for you. Let’s go through the code if you want to.

Where did you read this that you’re just repeating it from. “Freezing code for the merger”. None of these details are even important. The article is about Ethereum mining ending. Who gives a shit when the code is frozen to merge? Did I say it was happening in a week? What difference would it make if it was already scheduled for July? Then you would take it seriously or something? What are you talking about? You’d just dismiss it if it was scheduled. You’ll still dismiss it when it IS frozen.

What will it be then? The EIP doesn’t have finalized status? Is that what you will hold on to? Then what? “THE PATCH ISN’T LIVE ON THE SERVER YET”. You can do this same thing you’ve been doing right up until the point Ethereum mining ends, and I predict that you will. It’s like boiling a frog in hot water. Your temperature just slightly adjusts but you don’t realize how hot it’s really getting until it’s too late.

This has been literally 8 YEARS in the making with constant code you can track if you were really interested in such things. You can already see it. You’ve boiled that all down to having a scheduled code merge? That is literally like the last second! Do you understand when they freeze the code for the merge they can’t do ANYTHING like even fix a bug? It’s the last thing they will do before it goes LIVE. You’re planning your mining based on this? What? My God man, I’ve been buying ASICs since 2020 preparing for this. What is your plan?

You’re waiting for the freeze? To even start planning? I guess that is why I was mining Ethereum already before this bubble even started (years before actually) and am more than prepared for this and you were, what exactly? (PROOF). Look at me catch that Ethereum wave and how idealistic I was back then. I hadn’t made enough money mining to leave my job yet. And when you get left behind again I’ll already be doing what you catch up to (hint: I already am).

People like you shit on me when I started mining Eth too. Back then Eth looked like a joke compared to BTC. You always get shit on when you’re the first. Then they follow you when they see how paid you got but most of the gains already went to us for being first. You guys never have any points. You never have any plan. You’re always following the herd repeating nonsense you saw on reddit or somewhere else.

Redirecting that denial energy could get you a long way as the hour is quite late. You’ve already literally missed 96-97%ish of the mining gains that already changed my life. You’d already missed probably 50-60% of them to be honest with you before this bubble started (literally before most of the haters here had even started buying 5x priced GPUs). If you want to push that hard right up until you go flying off a cliff chasing that last 3% it’s yours. It’s more efficient for me to go for the next 50-60% gains part right at the beginning before the herd comes than to chase that. This has been all used up and I’m looking for the next one. Again. That is what successful people do in crypto. They do not cling onto the old thing.

There’s no convincing someone like you, and you left precious little to even dispute. You just didn’t like it. There’s even better arguments you could have given but I won’t help you with them. It doesn’t matter to me. You will learn either way and being mad at me will not help you.

Not really I am mining on 3080s it’s still decent profitable to me. Made a lot last year sure it’s 50% less profit these days but not as you described

Hey Balu,

Welcome! So my numbers are about the same as yours. I have my 3090, my 2080 TI, my 2 1080s, and 7 5790 XTs going. These have been mining for years. They will continue to mine until Ethereum is dead.

My recommendation is *NOT* to quit mining if you already have GPUs and hardware going. That’s definitely not what I’m saying. I probably have more Ethereum mining than some of the people trying to shit on this, more at stake, have made more and will continue to make more than a lot of the people that are freaking out about this article. Mining Ethereum.

The article is meant more for people who are either trying to buy *more* GPUs or people who may be trying to buy for the first time. That is where it’s a dicey proposition. Hopefully that helps!